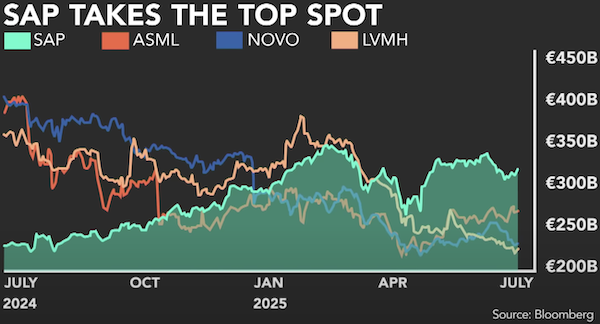

While LVMH dazzles in shop windows and Novo Nordisk dominates the weight-loss headlines, SAP has quietly climbed to a EUR322 billion market cap, cementing its place among Europe's elite. Its enterprise software runs under the hood of over 90% of Fortune 500 companies, powering everything from Coca-Cola, Apple, Walmart, to Nestle.

Born in 1972 from a group of ex-IBM engineers, SAP was built on a transformative idea: to unify company operations and process data in real time. Today, SAP's software is so deeply embedded in global business infrastructure that removing it would be akin to rewiring a plane mid-flight. That's what makes the business so sticky.

Still, that dominance hasn't gone unchallenged. Fierce rivals like Oracle, Salesforce, and Microsoft are circling. Yet the market is optimistic, SAP is priced at a lofty 40 times earnings, richer than Microsoft, Meta, or Apple. That premium reflects investors' belief that SAP will execute flawlessly from here by embracing AI, adapting to EU regulation, and fending off its many competitors. I'm not that optimistic.

Our preferred player in this space is Microsoft, by far. While SAP is deeply entrenched, Microsoft combines the breadth of cloud infrastructure (Azure), the ubiquity of Office and Teams, and fast-growing enterprise AI products like Copilot. Microsoft is also on your phone, in your browser, and behind your ChatGPT. It's diversified, dominant, and still growing fast, a rare trifecta.