Market scorecard

Yesterday, Wall Street ticked slightly higher as traders sifted through Trump's latest tariff comments. We are starting to sound like a stuck record. The S&P 500 hovered near record levels, buoyed by signs that he is open to more negotiations. Eight of the S&P 500 sectors were in the green, with industrials leading the charge.

In company news, LVMH slipped 1.7% in Paris after an Italian court placed its luxury cashmere brand, Loro Piana, under judicial administration for a year. The move follows allegations of worker abuse within the brand's supply chain. Elsewhere, Autodesk has walked away from a potential acquisition of PTC, shelving what would've been one of the year's biggest deals.

At the close, the JSE All-share closed down 0.43%, the S&P 500 rose 0.14%, and the Nasdaq was 0.27% higher.

Our 10c worth

Byron's beats

Having a large user base has proven to be very valuable in this day and age. Companies have found many innovative ways to monetise their users, including advertising and selling add-on services. Using the data to enhance the experience through AI is a relatively new concept, but it is making waves.

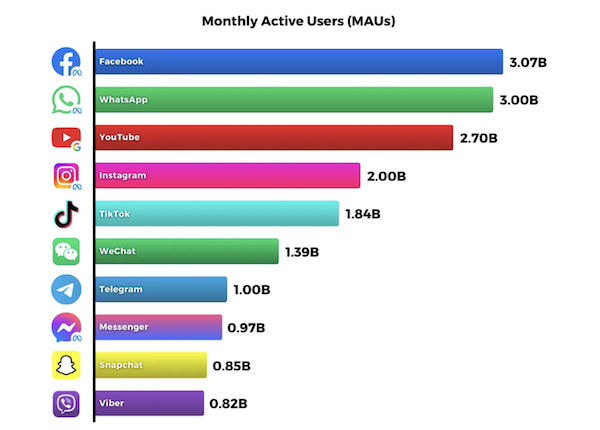

The guys from Carbon Finance put together a nice graphic showing the largest social networks by Monthly Active Users (MAUs). This is, of course, constantly changing so it is nice get a fresh take of the numbers.

Meta owns 3 of the top 4, and 4 of the top 10 which is quite incredible. I was surprised to see Telegram and Viber with such big followings. YouTube (owned by Google) has had a recent spike in users and is now considered a social network due to their Shorts feature. I guess that makes sense.

WeChat is owned by Tencent which is partly owned by Naspers/Prosus so many of our clients also have exposure there. In other words, Vestact is heavily exposed to large social networks and we plan on remaining as such.

Michael's musings

Meta is going all in on AI - maybe it is time for a name change? On a Thread post yesterday, Mark Zuckerberg announced that Meta plans to spend hundreds of billions on computing power to build superintelligence. The company's free cash flow last year was just over $90 billion, which means they plan to spend all of their free cash on AI and data centres. In my book, that is better than a pile of money building up on the balance sheet doing nothing. Our GDP is around $400 billion, and Meta will spend that on developing AI over the next five years.

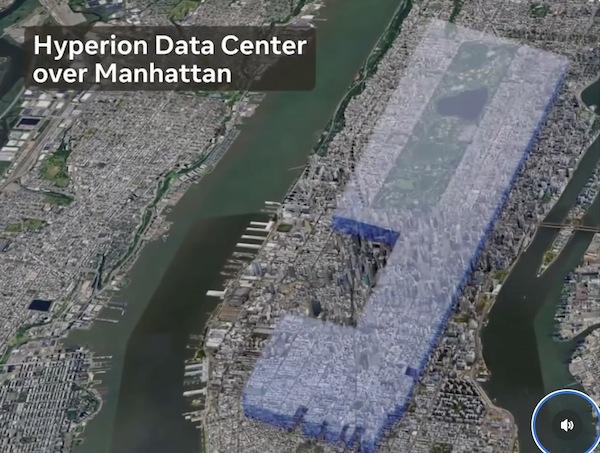

Next year a 1GW data centre will come online called Prometheus, and will use 500 000 Nvidia chips. There is an even larger data centre being planned, called Hyperion, which is expected to produce 2GW of computing power by 2030 and then continue to ramp up to 5GW in the years following. To give you context of the size, that data centre will use more energy than Medupi produces and will be nearly the size of Manhattan Island. See the image below, I screen-grabbed it from Zuckerberg's video post.

These are transformational hardware investments from Meta, to go with the expensive super-team of AI researchers recently hired. The company is positioning itself to be an AI leader. Will the likes of Microsoft and Google follow with similar spending patterns?

Bright's banter

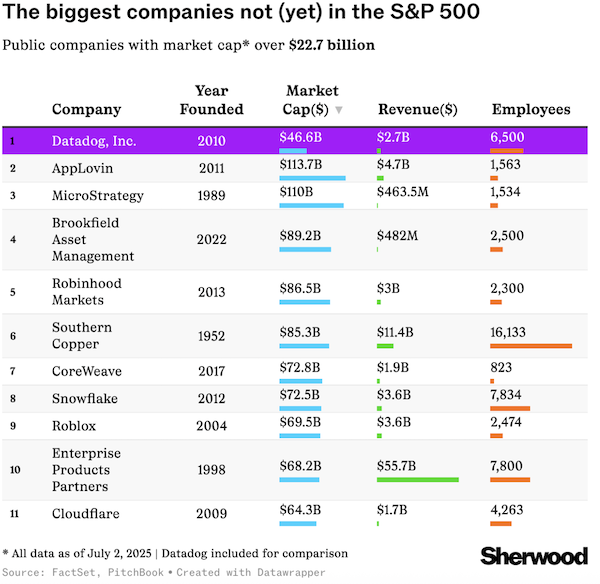

Datadog is officially in the S&P 500, replacing Juniper Networks, and the stock popped on the news. This is another win for the tech sector, which keeps expanding its footprint in the index with names like DoorDash, Dell, Palantir, Workday, and Super Micro all recently added.

Getting into the S&P 500 isn't just symbolic - it brings a wave of buying, thanks to significant index tracking. Admission requires a large market cap, at least 12 months of US trading, and certain criteria for shareholding, profitability, and liquidity. Datadog, now worth $47.4 billion, met every requirement.

Still waiting for their shot? AppLovin, MicroStrategy, Robinhood, CoreWeave, Snowflake, and Roblox. The infographic below shows the list of potential companies that could join the S&P 500 soon.

Linkfest, lap it up

In 2008, Buffett bet $1 million on the S&P 500. He made a wager that the index would outperform hedge funds over 10 years, he won easily - There is a new bet now, private equity vs the S&P 500.

The internet is salty about a recent pro tennis match. Bill Ackman, hedge fund manager, received a wild card entry - Andy Roddick slams billionaire's pro tennis debut as 'the biggest joke'.

Signing off

Asian markets are mixed this morning. Investors are feeling cautiously optimistic after President Trump hinted the trade war could wrap up by the end of this month. For now, markets seem to be reading his tariff threats more as a tough-guy negotiating tactic. Hong Kong, India, and Taiwan all edged higher, while Japan, mainland China, and South Korea ebbed.

In local company news, South32's aluminium smelter in Mozambique, Mozal, is in limbo over its future power supply. After six years of back-and-forth with HCB and Eskom, the company still hasn't secured an affordable electricity tariff, raising questions about the smelter's long-term viability.

US equity futures are slightly higher pre-market. The Rand is steady at around R17.89 to the US Dollar.

Today, we'll see earnings reports from JP Morgan, Wells Fargo, BlackRock, and Citigroup. It is the start of another important earnings season. Strap in.