Market scorecard

US markets ended higher yesterday as big tech came roaring back. The S&P 500 is near all-time highs, despite ongoing trade tensions. Trump is throwing bombs, and Brazil was the latest to receive a 50% bitch-slap.

Nvidia was the lead steer last night, that stock is now up over 20% for the year, and was briefly valued above $4 trillion in market cap, the first listed company ever to reach that level.

In company news, Autodesk is kicking the tyres of rival engineering software company PTC Inc for a potential takeover, sending the latter's shares up 17.7%. Elsewhere, advertising giant WPP fell 18.1% after cutting profit guidance on weak demand and disruptions from AI alternatives.

At the closing bell, the JSE All-share closed down 0.03%, but the S&P 500 rose 0.61%, and the Nasdaq marched 0.94% higher. Good times!

Our 10c worth

One thing, from Paul

We like to crow about the fact that our Vestact model portfolio has handily outperformed the S&P 500 over the last decade.

Since the S&P 500 is our benchmark, let's look at what's under that hood. It's important to understand that it is capitalisation weighted, so the most valuable companies have the greatest influence on its progress.

The 10 largest components are Nvidia (7.1%), Microsoft (6.8%), Apple (5.8%), Amazon (3.9%), Google (3.6%), Meta Platforms (3.0%), Broadcom (2.3%), Berkshire Hathaway (1.8%), Tesla (1.8%), and JPMorgan Chase (1.5%).

Near the bottom of the list are some companies that are rather insignificant. Caesars Entertainment and Enphase Energy have market caps of around $6 billion. Both are just 0.01% of the index.

Companies that are doing badly often get kicked out and replaced by up-and-coming giants. Michael Cembalest of JP Morgan counted the number of "negative index removals" from the S&P 500 (ignoring benign index removals resulting from stocks acquired at a premium, mergers and offshore reincorporation). There were 320 since 1980.

Byron's beats

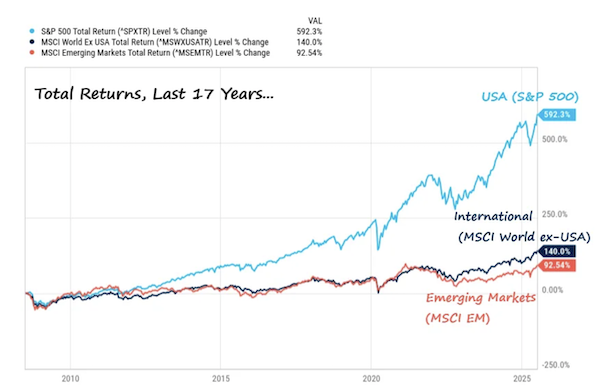

So far this year, US markets are up 7.5% while the MSCI World Index ex-USA is up 19.6%. The MSCI Emerging Markets index has also done well, up 16.5%. Vestact is almost exclusively long US stocks; should this be a cause for concern? Definitely not, in fact it's about time the rest of the world showed some signs of life.

Take a look at this graph. Over the last 17 years, US stocks have gained 592%, but international stocks are up just 140% and Emerging Markets have grown by only 93%.

Despite many challenges over the last few decades, including the ones right now, the US remains the central hub for capitalism, entrepreneurship, innovation and hard work. We don't see that changing anytime soon.

Michael's musings

A family member is looking to sell their house. I was astonished to see how many different estate agents are around. There are the national brands, and then a whole host of local agents, many of whom are one-man bands. The barriers to entry in that profession are rather low and the payoffs can be good, up to 7.5% of the sales price.

My wife is an architect who had to study for 5 years, pulling all-nighters regularly. After that she slogged through two more years of work experience and finally a regulatory exam. Yet architects will earn a similar amount for designing and managing the build of a house, as an estate agent will for selling it. Life is full of these asymmetries, where the effort that you put in and the value that you add to society doesn't always correspond to what you get paid.

As an aside, if all the national estate agent brands decided to cap their commissions at 3%, I think they would make more money than they do now. Many of the one-person agencies would go out of business, meaning a lower commission on each sale, but significantly more sales, resulting in higher profits.

Bright's banter

A fresh win in the chip world: tech billionaire Weili Dai is set to pocket $237 million as Qualcomm snaps up Alphawave IP Group in a $2.4 billion deal, expected to close next year.

Alphawave is a Toronto-founded chipmaker specialising in high-speed connectivity. It was listed in London in 2021, the stock is up 90.3% year-to-date, now giving the company a market value of $1.4 billion.

Dai, who holds around 96 million shares, became Alphawave's interim executive director last year following the passing of her husband and company director, Sehat Sutardja. The two previously co-founded Marvell Technology back in 1995, now a $50 billion+ giant in the chip world.

The UC Berkeley-trained computer scientist and former semi-pro basketball player from Shanghai remains active in tech with roles at AI search firm MeetKai, Lark Health, and Astrana Health.

The Qualcomm deal will push her estimated net worth to $3.3 billion, and highlights once again how critical semiconductor infrastructure is in the AI era, not just for data centres, but for everything from smartphones to self-driving cars.

Linkfest, lap it up

It's generally frowned upon to rate someone's looks. This website is doing it anyway, risking getting cancelled - Which Manhattan restaurants have the best looking diners?

White texting is where people 'hide' words in their work. These prompts are picked up by AI, but not by humans - 'Positive review only': Researchers hide AI prompts in papers.

Signing off

Over in Asia, NTT just pulled off the biggest global bond deal ever by an Asian company, raising $17.7 billion in a mix of dollar and euro-denominated debt on Wednesday. Meanwhile, CATL's Hong Kong-listed shares are trading at a record premium to their mainland China counterparts, showing strong offshore demand.

In local company news, Nedbank just made a power play, hiring FNB Business CEO Andiswa Bata to head up its Business and Commercial Banking division. On the mining front, it's been a good three months as Anglo American, BHP, and Glencore have collectively added over R400 billion to their market capitalisation as copper prices hit record highs, helping the trio reverse their losses from earlier in the year.

US equity futures have retreated slightly pre-market. The Rand is at around R17.75 to the US Dollar.

As they say in Brazilian Portuguese, "tchau."