Market scorecard

Wall Street kept the rally going yesterday, and both the S&P 500 and Nasdaq notched fresh record highs. Investors ignored Trump's attack on Brazil and focused instead on jobless claims coming in lower than expected, and a well-received 30-year bond auction.

In company news, Tesla surged 4.7% after announcing plans to roll out its Robotaxi service in California and Arizona. Elon also said his AI chatbot Grok will soon be deployed in Tesla cars. Delta Air Lines soared 12% after reviving its full-year profit forecast, saying that travelers are back in droves. Lastly, Ferrero, the company behind Nutella and Ferrero Rocher, snapped up WK Kellogg for $3.1 billion, doubling down on their US expansion.

In summary, the JSE All-share closed up 0.14%, the S&P 500 rose 0.27%, and the Nasdaq was 0.09% higher. Splendid.

Our 10c worth

One thing, from Paul

In his book 'Same As Ever', Morgan Housel notes that "the trick in any field - from finance to careers to relationships - is being able to survive the short-run problems so you can stick around long enough to enjoy the long-term growth."

With so much change going on in the world, including Trump, war, AI, rising temperatures, floods, migration, collapsing birthrates and more, it's tempting to hunker down and resist progress.

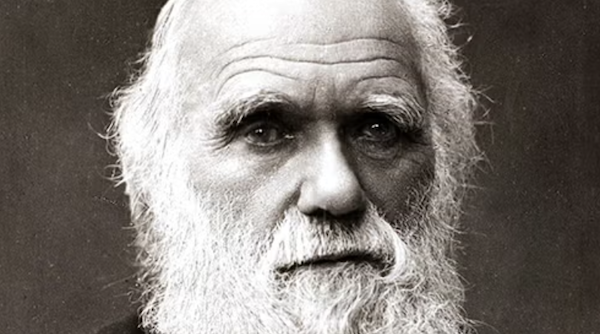

Don't do that, just keep smiling and embrace it all. Charles Darwin once said, "the people who survive are not the most intelligent, but the ones most responsive to change."

Byron's beats

There have been quite a few share sales recently, by employees and founders of companies like Nvidia, Meta, and Amazon. The media likes to call this a "red flag" on the basis that insiders are selling because they think the future of the company is bleak.

I don't think that this is the case here. Close your eyes and imagine you are a senior Nvidia employee who has worked there for the last 12 years. Your shares in the business have rocketed to a value of $400m due to ongoing incentive schemes and, more importantly, the share price marching higher. What a wonderful daydream!

You now have huge single stock risk. You've watched Nvidia (and your life's savings) halve in value twice in the last 5 years and drop more than 30% on numerous occasions. You decide to take $100m off the table so that your children's children have a cushy future. Is that understandable? I would say definitely yes.

Ok now open your eyes and get back to your day job, you do not have $400m worth of Nvidia shares to worry about.

Michael's musings

Microsoft saved over $500 million last year by introducing AI at call centres, which the company says also improved customer and employee satisfaction. On top of the savings in the call centres, the company has used AI to write around 35% of the code for new products.

This number is important for two reasons. The first is that it's proving the use case of AI, and justifying the tens of billions of Dollars being spent across the industry on AI development. If Microsoft can save $500 million in just one department, they will be willing to spend hundreds of millions each year on AI services, and so too will many other companies.

The second reason that it is important is because it demonstrates the efficiency gains that AI is going to bring to the corporate world. Now that markets are at record highs, clients sometimes ask where will future growth come from? Part of the answer is from these efficiency gains brought on by AI. More profits without needing revenue growth.

The age of AI is here.

Bright's banter

I just came back from two weeks in Italy and will be spending a couple more in Belgium and Hungary soon, so naturally, I've been hopping between Airbnb, Expedia, Agoda, Kayak, and Booking.com. Turns out three of those (Agoda, Kayak, and Booking.com) fall under the Booking Holdings stable, a $184 billion online travel empire.

If you remember Priceline's "Name Your Price" gimmick with Star Trek actor William Shatner, you'll be pleased to know that its smartest move wasn't the ads, it was buying Booking.com in the early 2000s for just $294 million. A steal, in hindsight.

Booking.com's story begins in 1996 with a Dutch grad named Geert-Jan Bruinsma, who scrappily stitched together a travel site with a bit of borrowed Hilton code and a lot of hustle. The company bet on a key differentiator: the agency model. Unlike Expedia, which collects cash upfront, Booking lets you pay at the hotel, a subtle shift that converted more window-shoppers into actual guests.

Their flywheel is that more bookings generate more cash that can be spent on more Google ads, leading to even more bookings. They also have a culture of tinkering, called A/B testing, running more than 1 000 of these live at any given time, tweaking everything from button shades to discount banners, all in the name of bumping conversions by a few basis points. When you're processing 1.5 million bookings a day across 31 million listings in 200+ countries, every decimal counts.

That relentless obsession with optimisation, paired with timely acquisitions and a flexible business model, is what's made Booking the kingpin of the $1.5 trillion travel industry. Booking is bigger than Airbnb, Marriott, Hilton, and Expedia put together.

We are currently adding Booking shares to client portfolios, if they are able to add fresh cash to their accounts.

Linkfest, lap it up

Most people think of aging in a linear fashion. Researchers now think it happens in bursts - Suddenly feeling old?

Many companies are turning to AI to improve their processes. Some have forgotten even basic security procedures - McDonald's AI hiring bot exposed millions of applicants' data with 123456 password.

Signing off

Indian markets opened in the red this morning as investor nerves kicked in after US President Trump pressed ahead with his tariff agenda. Meanwhile, the rest of Asia is holding steady with Australia, Hong Kong, South Korea, mainland China, and Taiwan all trading in positive territory.

In local company news, Nampak's turnaround is gaining momentum. The packaging group reported an 11% jump in revenue to R5.6 billion, with trading profit up a solid 22% to R764 million for the six months to March. A big boost came from paying down debt, helped by offloading noncore assets, most notably the headline sale of Bevcan Nigeria for R1.3 billion.

US equity futures are marginally lower pre-market. The Rand is trading at around R17.75 to the greenback.

Have a good Friday and a blessed weekend.