Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

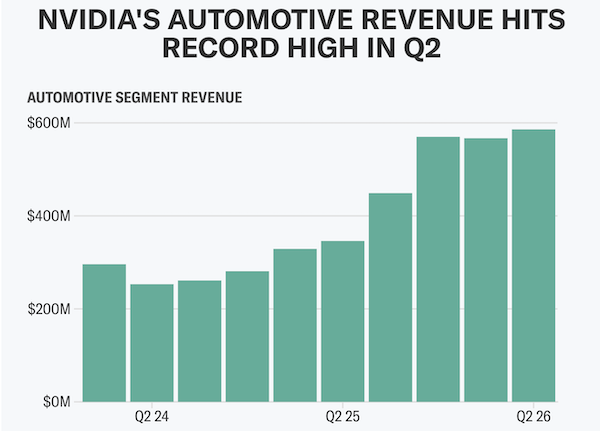

Nvidia's data centre sales overshadow everything else the company does, but quietly in the background, its vehicle arm is starting to become a serious business in its own right.

In the latest quarter, Nvidia's automotive revenue reached $586 million, a 69% increase year-on-year, driven largely by demand for its self-driving solutions. The big milestone was the launch of Drive AGX Thor, the successor to its Orin platform, which combines Nvidia's chips with its DriveOS software to form a "full stack" for advanced driver-assistance systems.

Toyota is among those adopting Nvidia's awesome tech, joining Mercedes-Benz, Volvo, BYD, and Foxconn. CEO Jensen Huang has previously guided that the auto division should pull in $5 billion this financial year, with an eventual path to becoming a trillion-dollar business. That may sound ambitious, but Nvidia's reach into the future of transport keeps expanding.

Tesla uses Nvidia GPUs in its supercomputers and, with the EV maker shelving its Dojo project, it will lean even more heavily on Nvidia chips to train autonomous driving models. Waymo, Alphabet's robotaxi unit, also taps Nvidia hardware for its fleet.

The convergence of robotics and supercomputing is what Huang calls "physical AI" - cars, robots, and machines using AI to interact with the real world. He sees this as the first multi-trillion-dollar opportunity for robotics, with Tesla's Optimus robot and robotaxi ambitions fitting squarely into that vision.

There are many reasons to like Nvidia. Beyond its grip on AI data centres, it is becoming central to the automation of industries from cars to robotics. That breadth makes the company not just a one-trick chipmaker pony, but a critical enabler of the next industrial revolution.