Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

The biggest and most important company in the world, Nvidia, reported results on Wednesday night, and they were once again outstanding. Earnings per share grew by 54%, revenues increased by 56% and a $60 billion share buyback program was approved.

The stock now trades at around 30 times forward earnings. The current price-to-earnings ratio is 42, with those earnings expected to grow by 42% per annum for the next 2 years. If you like using a PEG ratio (PE divided by growth) for valuing a company, then you are sitting at 1, which is apparently the "correct" level.

The Chinese situation is confusing. They did not sell any of the new H20 chips designed for Chinese consumption. They are waiting for new rules from both the US and the Chinese governments, so they took all potential sales to China out of their forward guidance. This seemed to be the reason the share price dropped slightly after the release.

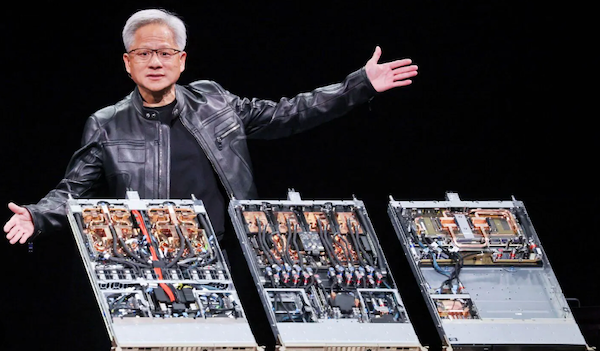

Data centres, or as Nvidia likes to call them, "AI factories", were the star of the show again, making up 86% of sales. Because Nvidia remains so far ahead of the competition, when they launch new products, clients like Microsoft, Meta, Amazon, and Google are forced to buy them or risk being left behind by the competition. It is quite incredible how they manage to release new products with such improved performance each time. For example, Blackwell (the latest chips in circulation) is 50 times more energy efficient than Hopper and is boosting training speeds by 7 times. The next generation, called Rubin, will be another big leap forward.

Management estimates that the AI infrastructure boom is a $3-$4 trillion opportunity. The cloud providers are spending $600 billion a year on capex, so that actually sounds like a lowballed estimation. I wouldn't be surprised to see Nvidia crest a $10 trillion valuation in the not-so-distant future. This stock still has legs.