Visa. The card that supposedly takes you places and enables you to be in a cashless world, engaging through the best payment network in the world to debit your account, in your currency. Making it easy to perform the same transactions both inside of your borders and in other countries across the world. The direct translation from Latin for Charta Visa to English (according to Wiki) is "paper that has been seen", which makes sense why the business is called Visa. Nice. The company operates in over 200 countries and territories (36 million merchant locations) and according to the 2013 Annual report, the company has four defining characteristics:

1. We are a payments network.

2. We are a partner and enabler to those who have direct relationships with consumers, businesses, merchants, and now also those who can accelerate the electronification of payments.

3. Superior technology and innovation are critical to our success.

4. We strive to always be the best way to pay and be paid for everyone, everywhere.

As such, this company falls broadly into two investment themes for us, firstly consumer related activities and secondly technology. More upwardly mobile consumers able to spend more money in the consumer space. The company can process 47 thousand transaction messages a second. Everyone expects this payments system to work all of the time. Visa are trying to enable a cashless world, where checks and physical cash will be a thing of the past. The win will be for everyone, the consumer, the service provider and do not rule out the regulators, who would love to have an electronic record of every transaction for the purposes of taxable events. Visa is not a bank, they do not extend credit, they are a payments system enabling debit and credit card payments.

But you knew all of this already,

let us take a look at the Visa Q2 2014 results, from last evening post the market ->

Net Income of $1.6 Billion or $2.52 per Diluted Share. Revenue for the quarter was 3.2 billion Dollars, that is on 15.4 billion processed transactions, representing a 7 and 11 percent increase respectively over the corresponding quarters. Profits were 26 percent higher at 1.6 billion Dollars. On a per share basis they were 31 percent higher, as a result of the buybacks, 2.52 Dollars a share. That includes a tax benefit of over 200 million Dollars. Excluding that tax benefit, earnings per share translates to 2.2 Dollars per share.

The share repurchase program was 5 million shares bought above 217 Dollars a share, with three billion Dollars still available. Buy now, the share price is lower! That is approximately 2.8 percent of the shares in issue, not to be sneezed at. The dividend is 40 cents a quarter, so at 1.6 Dollars year, it is hardly a kings ransom. The outlook was a little muted, currency headwinds also saw lighter than anticipated revenue for the quarter. Revenue growth expectations were lowered by around 2 percent for the year, and that is exactly what led to a four percent sell off after hours, the stock is projected to open around 200 Dollars. Which mean that year to date it is around 5 percent down. Not good.

But the future of this company is really bright. The room for growth is huge. The company continues to invest and offer payment systems suited to specific environments. The purchase of South African business Fundamo (middle of 2011) has had Visa utilise that platform in Rwanda with mVisa. MasterCard have useful insight into the cash market, and why we should all be electronic:

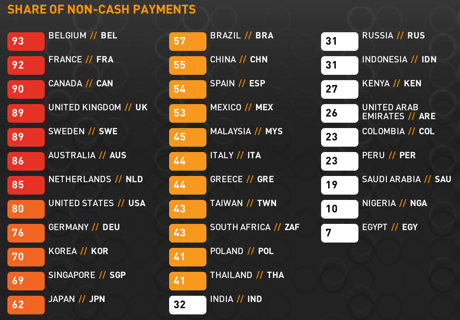

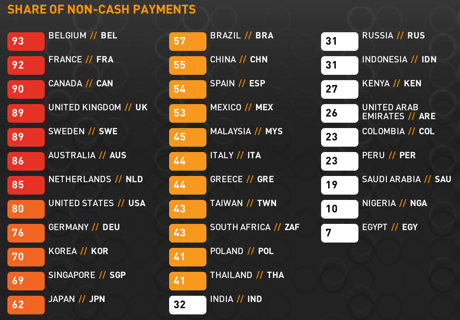

"Today, around 85% of all retail payment transactions are done with cash, equat(ing) to 60% of retail transaction value." and "cash costs society as much as 1.5% of GDP"

And then all the places in the world where cash is still used:

Loads of opportunities for all payment companies globally, including Visa and their rival MasterCard. We continue to add to this company, using current weakness, and it remains a firm buy.

Loads of opportunities for all payment companies globally, including Visa and their rival MasterCard. We continue to add to this company, using current weakness, and it remains a firm buy.