Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Not feeling the market glow yesterday was one of the Vestact firm recommended stocks, MTN, which reported subscriber numbers yesterday. The market liked the numbers like they liked flat and warm ginger beer. In other words not that much. The stock sank 3.76 percent to end the day at 20820 on 1.36 billion Rand worth of value! Yowsers. But to put that into perspective, it is around 35 percent more than usual. MTN trades nearly one billion Rand a day, which is strange when you think that the entire market cap is 389 billion Rand. At that sort of run rate, the entire market cap of MTN turns over in around 20 months worth of trading days, in my narrow minded long term view, that is completely nuts. We have clients who have owned this stock for around 11 years. And it is probably one of those companies that you could own for another decade, as African communication continues to evolve and grow in a data direction.

Did you see this chart of the day via the BusinessInsider which pointed to the Flurry Blog which indicated that we are turning into an addict of another kind? The mobile kind. Check it out -> The Rise of the Mobile Addict. Why is this relevant to this discussion about MTN? Well, quite simply, whilst their subscriber base growth was muted for the quarter to end March, data consumption continues to rise at a rapid rate. You can download the release here: MTN Group records 210,1 million subscribers, with that confirmation about data: "Data revenues bolster performance increasing 43,3% year-on-year (YoY)".

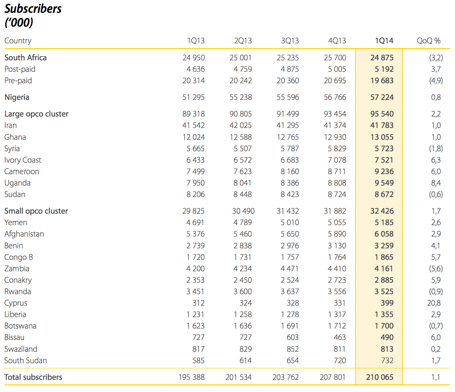

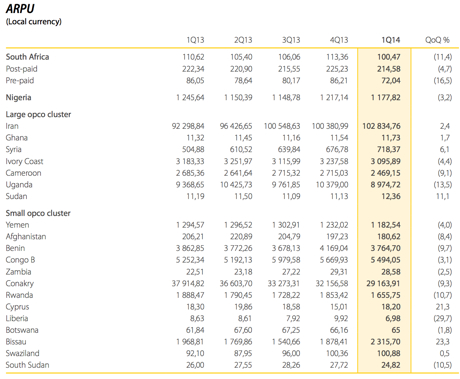

Concerns about two of their largest markets, South Africa where "subscriber numbers reduced by 824,768 bringing total subscribers to 24,9 million at the end of the quarter. This was largely due to the disconnection of 973 064 subscribers who had been showing activity but not generating revenue as per our 90 day RGS requirement." And then in Nigeria, where a one month ban of sales of sim cards saw a marginal growth in the subscriber base to 57.2 million, but market share slipped to 49.3 percent. In Iran and Ghana, subscriber growth was only 1 percent too, not helping the larger four of their markets. ARPU's slipped, we are still in the zone where call rates will continue to fall (here locally MTN have slashed call rates to send a clear message to Cell C), but data will continue to become a whole lot more dominant.

So here are the subscriber numbers for the quarter:

And then the ARPU numbers:

OK, so you see the trend. Lower and lower on the ARPU's as calls get cheaper. What we noticed yesterday too was that Cyprus being the only mature market of MTN was seeing increasing revenue per user. On a side note, the S&P ratings agency upped their credit rating of Cyprus, so in part this uptick must be associated with a stabilisation and recovery of the country. I am guessing out loud here, but the Cypriots are probably very grateful that they did not side with the Russians.

We are not worried about the overreaction. ARPU's are astonishingly low and the data revolution will take place alongside better priced handsets primed for web functionality. I remember everyone saying in 2011 (around then) that the mobile companies were mature here in South Africa. Short term and narrow thinking. We continue to accumulate what is a great business.