Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

MTN results for the full year have hit our screens this morning. This is one of the companies that we have held for the longest for our clients, since we opened our doors for business over 11 years ago now. Why would we want to own such a business? Well, I guess communication is at the core of every single one of us, we want to be in control of our own personal and business communication. 6 and a half years ago, when the company reported in August 2007 (their interim results), they had 50 million subscribers. Now they have 207.8 million subscribers and managed to grow their subscriber base by nearly ten percent during the last financial year.

Thanks to a weaker Rand, these results have been juiced up, I guess that comes as no shock to you (even as you fill up with a petrol price of over 14 bucks a litre now) as living expenses continue to climb across this beautiful land of ours. Group revenue increased by 12 percent (3.1 percent in constant currencies) to 136.495 billion Rand. Astonishing. EBITDA margins increased to 43.1 percent (0.4 basis points better), whilst EBITDA increased by 13 percent (1.6 percent in constant currencies) to 58.820 billion Rand. Revenue in South Africa went backwards, whilst in Nigeria was up modestly, both businesses seeing interconnect rates falling and voice pricing coming under pressure. Remember that voice revenue is still 75.5 percent of total revenue, this includes interconnect fees.

Lean in a little now. Interconnect is 11 percent of group revenue, handsets are 4 percent, whilst SMS's (remember those?) are 4 percent of revenue. Interconnect revenue in South Africa was already 24.9 percent lower in the year, with the second half revenue being the lowest half since H1 2011. Lower tariffs and lower interconnect rates already have meant that the consumer has benefited. The first country inside of their subscriber base, namely South Africa, is starting to show signs of being mature from a subscriber point of view, and voice point of view, but data, that is the future.

But to give you an idea of how much more important data revenue is now, relative to five years ago, I did a quick search on the SENS releases from the year end. In 2009, when the 2008 annual results were released, the word data came up 3 times in the release. Today? 42 times. But yet data is only 15.1 percent of total sales, but is up 3.1 percentage points, or over twenty percent. Data users increased by a whopping 37.4 percent to 80.6 million people across the all their networks, but yet there are only (as of December) 34.8 million smartphones across the whole network. That means that only 16.7 out of every 100 handsets across the MTN networks are smart phones. Or, put another way, 83 and a bit of every 100 phones across the group subscriber base are not smart phones. So if you do not have a smart phone, is it then an average, or dare I say it, slightly dumb phone? Cost is essential here, cost of the handset and cost of the data relative to what you get in the end. That is why MTN continue to invest heavily in their network and have recently introduced a cheaper smartphone called the Steppa.

The Steppa? There is a recent review on TechCentral: MTN's R499 Steppa smartphone reviewed. Not the worst phone in the world for less than 50 Dollars, preloaded with all of those apps. So there you go, that is the MTN offering and might well be the first of several smart phones.

Back to simple valuations, earnings per share jumped to 1386 cents, up 27.3 percent from the prior period, the dividend increased by 25.6 percent to 1035 cents, the second half is 665 cents. Or, after tax 879.75 cents per share. At a share price of 20315 cents the yield is 4.33 percent after tax, the earnings multiple, historic of course, is 14.65 times. It is not expensive at current levels. The future always holds secrets that you do not know, a Rumsfeldian would say that this is an unknown unknown. The good thing, as Paul said the other day is that when interconnect rates get really low, they cannot go any lower. And whilst you may lose in revenue, interconnect revenue, they would also pay out less, they will not lose 11 percent of revenue.

Not being able to get money out of Iran is a temporary problem, a really big temporary problem, exactly how long I guess remains to be seen. Whilst these can be seen as profits, extracting them and sending them onwards to shareholders counts for everything, not so? I suppose that whilst they wait for the cash to come available, they will continue to invest in the network, the situation seems a whole lot better now in Iran than at the beginning of last year.

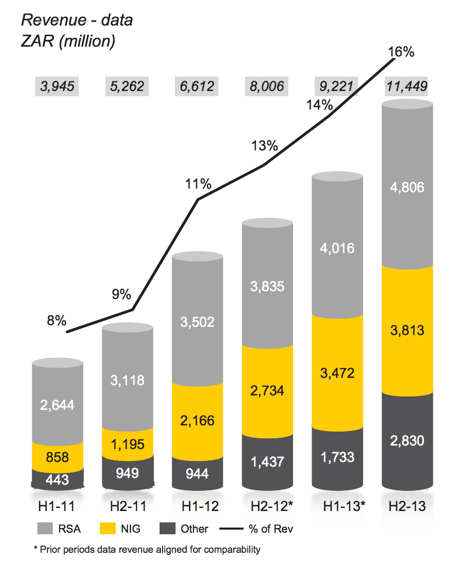

Not to try and drive home the point, but the data revenue climb from the Results for the year ended 31 December 2013 presentation. What is most pleasing is that Nigeria continues to grow quickly. What is important to note there is that the fixed line operator is basically nowhere, with all due respect.

I expect that whilst this is encouraging, it is still a small (but fast growing) part of revenue. Interconnect revenues are going to be hurt, there is no doubt about that. But we think that whilst South Africa is further ahead of the rest of Africa, we are still behind the rest of the world, with regards to adopting all of the technology that is still to reach our shores. Netflix is one that requires an enormous amount of bandwidth, MTN will of course be the provider as long as they continue to spend heavily in their infrastructure. We continue to be happy holders, adding on weakness.