Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Last week our biggest holding in New York, Visa released numbers for the first quarter of their fiscal year. Revenues increased 11% to $3.4bn while earnings per share increased 14% (thanks to big share repurchases) to $2.20. These numbers come off the back of payment volume growth of 11% which came to a whopping $1.2 trillion.

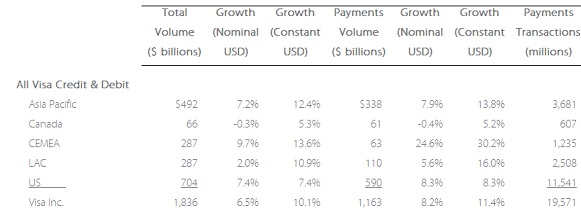

Below I have taken a table from their presentation which shows their geographic mix and where the growth is coming from (CEMEA stands for Continental Europe, Middle East and Africa). As you can see the growth is well spread out. Just less than 50% of their volumes now come from outside the US, this I am sure will be more than 50% after this year.

What is really exciting about this business is that the growth comes from 2 avenues. As people become richer and spend more, existing Visa clients swipe their card more often. The second growth avenue comes from cash users converting to card which so much more convenient for all parties involved (unless you are trying to avoid tax).

One of the biggest trends I picked up on when I went on my travels was how cash was still king throughout South America. Merchants trying to avoid taxes would charge an extra 10% if you wanted to swipe your card. This clearly has to change as the government adopts electronic payments to monitor cash movements.

We have an extremely advanced banking system here in South Africa. I am not sure about the other banks but FNB actually incentivises their clients to swipe more often. It is free to swipe and cash withdrawals attract a fee. This is to avoid FNB having to constantly transport cash to ATM's, a very risky business in SA. Of course a huge majority of this country still deal in cash and struggle to trust the banks, but this attitude is changing. I am sure you have heard the Capitec advert where they boast 100 000 accounts are opened a month. Times they are changing.

Visa almost sounds like a no brainer but that is certainly priced into the share price already. Nothing comes for free I am afraid. The company is expected to make $8.86 for the year of 2014. Trading at $215 it affords a PE of 24 times this year's earnings. But the company historically has grown earnings at 27% per annum over the last 5 years. Wow. Expectations are for 18.6% annual growth over the next 5 years.

Although the stock is expensive this is the kind of business that deserves a premium and I expect this share will maintain its premium while growing along with its earnings. The fundamentals are there to grow at 18% per annum, I see no reason why not. We will continue to add to this fantastic company.