Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Richemont have hit the screens with a sales update for the Third quarter to end December 2013. Off the bat the market is clearly disappointed, the stock in Joburg was down 4 percent as we opened. Mainland China reported lower sales than the corresponding comparative quarter, indicating that the measures taken by the Communist party are working. The austerity measures, the clampdown on people spending on luxury and that included the big billboard pulldown. Let us not rub the new found wealth in the faces of the many that have been left behind. Those many live of course not in the cities.

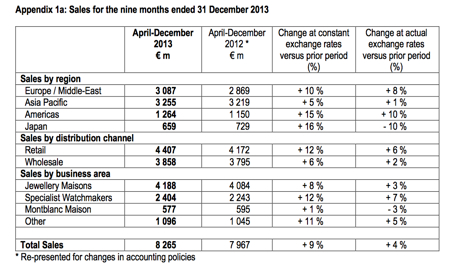

Here is a table for the nine months of trades, which does not differ too much from the three months sales growth of 9 percent in constant exchange rates and three percent in actual exchange rates.

It is encouraging for me to see that European sales have bounced, even though a lot of that is attributed to the tourists from the East visiting. Ironically the wonderful products that Richemont produce are a lot more expensive for their main clients, because of the duties back home. Another strong performance from the European slash Middle East part of the business might well put the Asia Pacific business dominance (from a sales point of view) at risk. China mainland will bounce back. Quality will prevail and as the Chinese currency continues to appreciate. The same goods will ironically become more affordable. The Chinese Yuan has strengthened by nearly 9 percent to the US Dollar over the last three years, and by four percent to the Euro.

So Chinese people will continue to be richer and will continue to be key to the future of the sales of not only Richemont, but any consumer orientated business with global ambitions. A simple McKinsey report from 2012 predicts that Chinese household disposable income would double from 4000 Dollars in 2010 to 8000 Dollars in 2020. And that level is still so far away from Japan (6 times more than China) and the US (9 times more than China). A blip, and perhaps a trend for a while, but we will continue to hold and accumulate the stock on weakness. A strong business.