Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

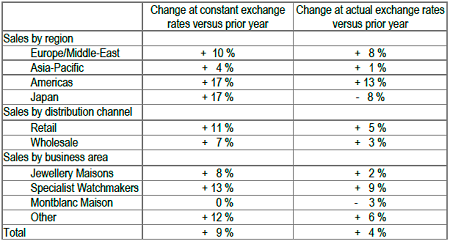

Richemont released a trading update that Mr. Market was not too happy with, expectations were missed. Just a bit, not by too much. The sales update (fairly short and sweet) can be downloaded here: RICHEMONT REPORTS FIVE MONTHS SALES AT ANNUAL GENERAL MEETING. Two surprises and I am going to use the table from the release to illustrate the point I want to make:

Check out the sales in the Americas and Japan, showing huge movements, whilst Asia-Pacific has been subdued, indicating that Chinese policy makers with their crack down on "gifting" is filtering through, as anticipated. That is the first point I want to make, sales in the developed world are starting to pick up strongly, whilst sales in the fastest growing (and now biggest) market of theirs, China, is starting to slow.

The second point I want to make is the Richemont sales in Euros, because whilst the company may be listed in Zurich, they report their numbers in the common European currency. The one shared from Athens to Dublin. In fact there are 17 official users inside of the Eurozone, 8 official users outside of the Eurozone (small places like the Vatican and Monaco) AND 3 unofficial users, including our neighbours to the North, Zimbabwe. Remember when the weakening Euro helped sales? Well..... it is different this time around, as they point: "At actual exchange rates, sales rose by 4 %, negatively impacted by the weakening of the US dollar and the yen against the euro."

What does this mean as a Richemont shareholder? Should you be spooked that sales are slowing? No, not really, because the business I suspect will continue to attract newer and more customers. Check this out: Where the World's Millionaires Liveóin 1 Graph. These are from last years "wealth report" but I suspect that we will continue to see the wealth of the developing world continue to rise.

What is quite interesting from this Economist piece: Cities and their millionaires is that Frankfurt has more millionaires relative to the rest of the cities inhabitants. I bet you 20 years ago that list would not have included Moscow, Shanghai, Mexico City, Beijing or even Seoul, let along Hong Kong! The world is changing, there are more of us and we are getting richer. That bodes well for businesses (like Richemont) that sell timeless and desirable luxury goods.