Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

What the .....? Well, it was something that I suppose we were expecting all along, in the wee hours of the morning here it was announced that Microsoft would be buying most of Nokia's cell phone business. Stephen Elop, an Microsoft guy who went to run Nokia, is now seen as the replacement for Steve Ballmer, who announced his retirement days ago. All good I guess for Microsoft shareholders, the companies suggested that they had been working on this deal for a while now.

Nokia is a shadow of its former self. What does that expression actually mean? Some shadows late in the afternoon can be quite long. The stock is down 84 percent in five years as the company lost handset dominance to a wave of newer smart phones that left the Finnish company ..... well, finished?

The announcement from the Microsoft investor relations website lays iyt all out for us, so we can think less and read more: Microsoft to acquire Nokia's devices & services business, license Nokia's patents and mapping services. Price tag? EUR 5.44 billion in cash. "EUR 3.79 billion to purchase substantially all of Nokia's Devices & Services business, and EUR 1.65 billion to license Nokia's patents"

Microsoft shareholders (I mean the company) get another 32 thousand mouths to feed, 4700 folks in Finland and 18300 employees "directly involved in manufacturing, assembly and packaging of products worldwide." Nokia might have lost dominance over the last 5 years, but the company still managed to sell 53.7 million phones in the last quarter. But as this sort of recent graph from a lovely piece from Visionmobile's blog titled The Apple and Samsung Profit Recipe shows it is actually not about the volumes and absolute numbers, but rather the profitability of the products that you sell.

Consumers are drawn to a wonderful product, and don't get me wrong, price point is very important, but the most expensive products are usually the best from a consumer experience point of view. But this is telling, the profits of smartphones belong to two companies, Samsung and Apple. Check what Nokia used to be and what it was, not so long ago.

Can Microsoft do it? The short answer is yes, I think that they can do it. Is it going to be easy? No. To topple Apple and Samsung off the pedestal that is hundreds of rungs up the ladder, it is going to take hard work. And determination. For Microsoft it is around 3 percent of their market capitalisation, but for Nokia shareholders it might feel like throwing in the towel on a terrible chapter in the company's recent history. Mind you, Nokia used to chop down trees and produce paper, this is probably just another chapter.

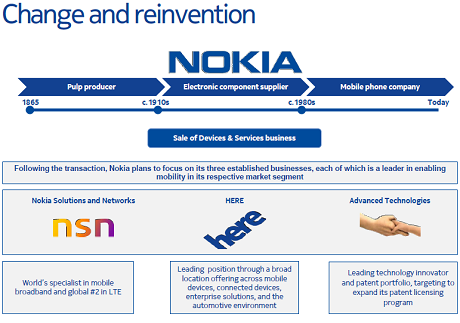

That is the question that I have not really seen asked, what now for Nokia shareholders, post the transaction. Well, luckily for us the investor relations people made us a slideshow to show us exactly what Nokia are going to do. Download the presentation and then scroll to slide 11 titled: Change and reinvention. I have taken the liberty of grabbing the slide to show you, put your glasses on:

Here, NSN and Advanced Technologies. That is what is left of Nokia. That is all I guess folks, good luck to Microsoft!