Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

What does a siren with a crown, two fish tails, long hair and your favourite morning brew have in common? Starbucks. A company founded in 1971 in Seattle. Their first shop was in Pike Place Market, next year the company plans to have 20 thousand shops across all six continents that you could have customers. Ironically, the continent that their brew might be most appreciated, Antarctica, does not have any stores. Just to show you how quickly their home market continues to grow, Starbucks plan to open 3000 new stores in the Americas alone. The source of the Sleeplessness in Seattle of both Tom Hanks and Meg Ryan might well have been too many lattes or espressos from Starbucks. Maybe. I can't remember how the movie plot runs, but I remember that the end is all too familiar with movies of this nature. Boy gets girl, girl gets boy. The end. No story of him leaving the toilet seat up and her forgetting that the big match is on this weekend. None of that.

But back to Starbucks, because we are interested in the business of business, and the business of selling what is quite possibly the only daytime drug that nobody frowns upon. I mean, a glass of wine at lunch or a cigarette on the street do not attract the same positive feedback that a warm steamy cup of coffee does. The smell for starters is better. The company is not only all about coffee, they also own bakeries and tea brands/outlets. Teavana, if that is your thing. Personally I drink both, tea and coffee. Starbucks have their own home coffee systems, so that at home you can feel as if you are there. At home I have the Nespresso machine, at work we have one too. The coffee is awesome. Bad coffee unfortunately is really bad, and that is both a problem and a good thing. A good thing because premium coffee is awesome, a bad thing because you become a coffee snob.

For the quarter ended 31 March 2013, total net revenues grew 11.3 percent to 3.555 billion Dollars, operating income was 26.4 percent higher at 544.1 million Dollars, net earnings grew to 390 million Dollars, an increase of 26 percent. This translated through to 51 cents a share for the quarter, an increase of 27.5 percent. There are fewer shares in issue as the company continues to buy back stock, 12 million shares less than this time last year. Which is around 1.5 percent fewer shares in issue. The plan is to buy back another 26 odd million shares, thus removing about three percent of the free float.

The quarterly dividend was hiked not so long ago to 21 cents a share. The stock sank afterhours, so perhaps we should use the indicated opening price today, 58.95 Dollars for the purposes of valuation. The yield is 1.43 percent, hardly a positive yield underpin. The forward multiple (using the number that I have seen for the full year by the company, 2.18 cents) is around 27 times earnings. But what are the growth rates? The expectations are for earnings to increase by 22 percent per annum for the next three years. So the PEG ratio (a like for like measurement for any company) comes out at 1.2 times. PEG measurement is simple, price to earnings multiple divided by earnings growth. Slightly more expensive than you would hope, but earnings are growing at a fair lick. Earnings could surprise on the upside. Astonishing margins, which are expected to continue to grow by as much as 30 odd percent to nearly 20 percent EBIT over the coming four to five years. Amazing. Just coffee.

And I say, just coffee, but this is even more amazing than I thought, the coffee consumption per capita statistics. I would have off the bat assumed that the Americans drink as much coffee as the French or the Italians. And I would have assumed that those two proud nations of coffee drinkers would easily drink more than everyone. But it quite simply comes down to simple geography. The Scandinavians slurp enormous amounts of coffee. Huge. More on that in a second, I wanted to understand coffee production, because that would give useful insight into the demand side. In the year 1990/91 all the countries that grow the stuff managed to collectively grow their output 93.253 million bags. Last year, and this information is courtesy of the International coffee organisation statistics page, the producers managed 144.646 million bags. That is a pretty massive increase in coffee production over a twenty odd year period.

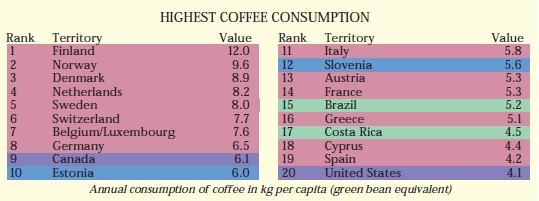

And this is more impressive, Brazil (50 million bags) and Vietnam (22 million bags) account for half of all production. Do you ever hear of anyone refer to a Vietnamese coffee blend> Nope. I learnt something new too, there are three different growing seasons for coffee, April, July and October. Different climates means that beans are harvested at different times of the year. Ironically, Starbucks opened their first store at the end of January in Ho Chi Minh City. Of the producers of coffee, Brazil is one of the few countries that enjoys high consumption. Back to that map of global consumption, because I think that this is important. From the document, Coffee Consumption, I have ripped the table out by way of an image:

Normally you would think that the Americans would be higher up on the list there. But their consumption on a per capita basis is 50 percent lower than their northern neighbours, Canada. That leads me to believe that there could be good growth opportunities for the company in the US, and there is evidence of that in the fact that the company are opening a huge number of stores in the coming years in their home territory.

And I have not even mentioned India or China, the homes of the tea drinkers once. Increasingly though, these two huge nations are becoming coffee drinkers. The US is 75 percent of their revenues, and there is still major growth here. Their Asia Pacific business, which includes China, is growing revenues and profits at 35 odd percent. Coffee is a soft luxury, Starbucks is a brand that people aspire to consume. The company is in good hands, Howard Schultz is 59, so I guess there would be some continuity questions. But he seems in good health and aggressive. The board is power, there are some really good members, including two ex Pepsi board members. And Robert Gates, the ex secretary of Defense. We continue to favour Starbucks as the correct entry point into what is a strong growing emerging market story, as well as well entrenched consumer culture in their home markets.