Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Ok, one of the most important stocks in the Vestact stable, Aspen Pharma reported numbers for the half year to end December. Revenues from continuing operations increased 20 percent to 9 billion Rands, operating profits increased by 24 percent to 2.5 billion Rands. This translated to normalised diluted headline earnings per share of 379 cents. Cash generated from operating activities grew 9 percent to 1.3 billion Rands. Gross profits grew 22 percent to 4.3 billion ZAR. Profits before tax grew by 29 percent.

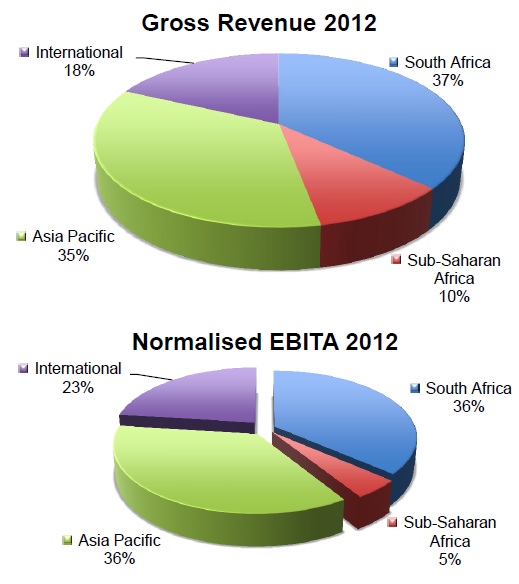

Ok, that was all the important numbers, the segmental revenue and profits view give you a pretty good idea that Aspen is no longer a South African company. 63 percent of revenue and 64 percent of EBITA comes from outside of our borders. Byron suggested on the box this morning that if the company did not have that sort of exposure the stock price from the South African earnings alone could be 110 odd Rands a share lower. I suspect it might even be more, the reason why Aspen commands a much higher rating relative to the rest of the market is that they have managed to grow aggressively. And that Asia Pacific springboard is wound tight in Australia, they have a twenty percent market share there in scripts written. See the numbers below, from the Segmental contribution for six months ended December, slide 17.

The great thing about their two major businesses, SA Pharma and Asia Pacific is that they both managed to grow revenues in excess of 20 percent. Margins have actually improved over the last two years, with group operating margin having increased 30 basis points from the prior comparative period. Just to give you an indication of how quickly this company is growing, revenue for this half is double what it was for the half four years ago. More than double in fact.

In their local business, the South African one, the core business had a good first half, the baby formula business did well. The ARV's business is expected to slow, you can imagine the margins are not that great. In the second half Aspen continue to expect the baby formula business to do well. I remember those days of baby formula, when you couldn't go anywhere without a couple of feeds. Those were the days my friends, they did end and the sleep sort of started. The next business division, the Asia Pacific business is where the real growth is going to come from. The move to use Australia as a springboard and to buy Sigma. I remember there were many naysayers back then, they were overpaying, remember? 6.1 billion Rands back then. I suspect that whilst that will capture the attention of the analyst community, the opening of a company on the ground in Nigeria is also exciting.

The reasons that I say that is because you must look at the territories that the company operates in and then this table, sort by healthcare spend to GDP, data from the World Bank: Health expenditure, total (% of GDP). At the top of the pile, if you order descending, the US is miles ahead of the major European economies, spending 18 odd percent on healthcare relative to GDP. Phew. Lower down, you have France at 11.9 percent, Germany at 11.6 percent, the Netherlands at 11.9 percent, that is seemingly the number. Ten to 15 years on however, because the data is supplied from the 1998 period onwards, those developed countries are spending 100 basis points more on healthcare than they used to. And although economic growth rates have been slow, the spend on healthcare continues to rise in rich countries.

Now, I am getting more to the point for Aspen. Let us look at Asia, the Philippines, Indonesia, Thailand, China and Vietnam, what is their spend as a percentage of their relative GDP? The Philippines, it is 3.6 percent. In Indonesia it is 2.6 percent. In Vietnam it is slightly higher at 6.8 percent, Thailand is 3.9 percent whilst in China, where the population is around 1.35 billion folks, it is not on this list, but a Bloomberg story (China Health-Care Spending May Hit $1 Trillion by 2020) suggests that it is around 5.5 percent, but could grow to 7 percent of GDP by the year 2020. The suggestion is that it would treble in the next seven years. Wow. And that is the point that is worth making, whilst richer countries continue to pay more for healthcare off a higher base, the real potential is in markets where medical spend is still low, but growing fast. And Aspen is well positioned in these markets, especially Asia and locally across our continent. I saw a report this morning on agriculture that predicted that by 2050, 81 percent of the worlds population will be in these regions. All needing better healthcare than they did before.

Valuations are really stretched, the stock has been on an absolute tear lately. The stock is up around 90 Rands from around 106 ZAR a year ago. Five years ago it was 30 odd ZAR. The increase in the share price has been meteoric. If the company makes a little less than 8 Rands for the full year to end September, the stock will trade on a 25 multiple at current price levels. Earnings however continue to grow at a really healthy click though, a 15 to 20 percent earnings growth rate should be the norm for the next two years. Driving the share price has been North American buyers, look at slide 28 on that same presentation, Distribution of fund managers. It is South Africans and Europeans that think the stock is expensive, because they are fewer.

Add to the potential of their Asian business to their robust and equally fast growing Latin America and African businesses and you can quickly see the reasons why investors are paying up for this stock. We continue to hold and add where we see fit, this is a decade long investment at least.