Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

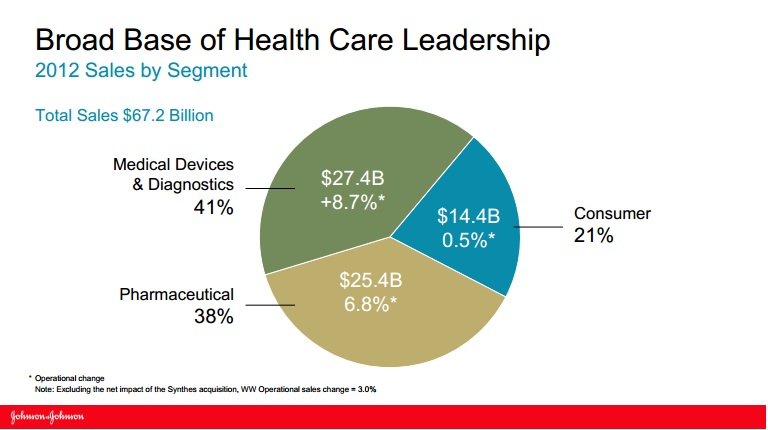

Yesterday we received quarterly and full year results from one of our staple holdings in New York, often called the bluest of blue chips, Johnson and Johnson. I have written about these guys on numerous occasions but as a reminder and because these numbers shift each quarter, below is the earnings mix of the company. This is for the full year 2012.

Let's look at the numbers for the year. Sales increased 3.4% to $67.2b whilst earnings increased 3.4% to $14.3bn. EPS came in at $5.10. There was a lot going on during the year which involved acquisitions and big product call backs. The share trades at $72.69 and with expectations of $5.41 2013 earnings, the stock affords a 13.4 one year forward valuation.

For the quarter, sales came in 6.5% higher. Here is what CEO Alex Gorsky had to say about the quarter.

"Our third-quarter results reflected continued sales momentum driven by strong growth of key products, successful new product launches, and the addition of Synthes to our family of companies. We advanced our pipelines with regulatory approvals for a number of new products, the submission of several new drug applications, and the completion of several strategic collaborations."

The company is massive with $14.3bn in earnings so the base is already high. Where is the growth going to come from? Health care is one of our 4 big growth themes and Johnson and Johnson are leaders in this industry. In fact 70% of their sales come from products which are either #1 or #2 in terms of market share. They have produced 29 years of consecutive adjusted earnings increases and can boast 50 years of consecutive dividend increases. On their website the dividend history goes back to 1972 where they paid a total of 9.3c compared to last year of $2.40.

But the company is also very innovative. 25% of sales came from products which have been introduced in the last 5 years. Products in the pharmaceutical division are growing well while medical devices are always a priority, especially for governments who are forced to spend on hospitals and medical care by their potential voters during this age of entitlement.

In this quarters presentation most of the hype was about JNJ's strategic alternatives to its Ortho Clinical Diagnostics business which deals mostly with blood transfusions. The talk of possible sale of this division again brought up rumours of more sales which could be a huge value unlock for shareholders.

We continue to use JNJ as safe exposure to the healthcare industry. The industry looks to have a bright future as the developed world gets older and the developing world gets richer.