Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Richemont have released a trading update for the nine months to end December 2012, and from the initial flash, they seem to have missed sales expectations. At least that is what the screens say in front of me. The stock has been on a tear. The stock is up nearly 70 percent over the last year. And every single time that I have spoken to clients about the company the inevitable question comes up asking, is there any more juice left in the share price? To answer that question one is perhaps best placed to try and understand a few things about the company and their customer base. The company falls into an investing theme that we like a lot that is called aspirational consumerism. The idea that across the globe there are more upper middle class people who are able afford luxury. In China a culture of gifting exists, whereby to seal a deal of most sorts gifts are exchanged.

I might not have a single smart watch, and might not be that sort of person, but many, many people love not only the timepiece but also the longer term emotional attachment. I was once (rightfully) admonished for being a cynic on their product and the buyers thereof. The fact is that most people like nice things. Tutankhamun over 3300 years ago had a gold mask made (along with the matching curse) because it was possibly the *nicest* way of showing off at the time. King Tut had many beautiful artefacts and treasures, amazing for only a ten year reign and bearing in mind that the fellow did not make it to 20 years of age!

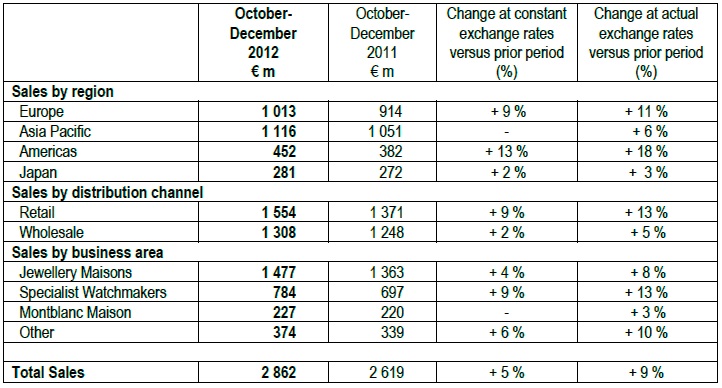

Off the subject, here is the skinny of the announcement, which can be found here -> TRADING STATEMENT FOR THE THIRD QUARTER ENDED 31 DECEMBER 2012: "Following several years of exceptional growth in the Asia Pacific region, in particular China, sales were flat compared to the demanding comparative figures for the same quarter last year." Boom. Rupert (Johann) the bear(ish) warned of slowing sales, in fact everyone has warned of slowing sales in mainland China. Check out the sales table:

I suspect however that this report will be met negatively by the market and perhaps we could see a short term slump, not too dissimilar to that of Burberry. And it turns out that Burberry, after a weak outlook are doing better than most folks anticipated. Out of the blocks the stock fell five percent here in Johannesburg. Slowing Chinese growth points to Chinese consumption going in the wrong direction, at least in the short term. But, as Richemont says: "At this stage, it is unclear how business patterns may develop and how the business in the Asia Pacific region will evolve in the near future. Richemont takes a long-term view in managing its business and will continue to invest in the development of its Maisons." Regardless of the short term demand story, the company will continue to invest. I suspect that anxiety over the Chinese growth story has abated a little, watch Chinese consumption patterns closely. Because strangely enough, notwithstanding Richemont having seen explosive growth in the region, the Chinese authorities having been trying their utmost to convince their general populous to shift to a consumption based mindset. We continue to accumulate the stock, and will use current weakness as an opportunity.

In unrelated news to the sales update, over the weekend there was an announcement that Richemont had entered into a JV with Chinese luxury goods retailer Chow Tai Fook. Now, I can understand you scratching your head, but Chow Tai Fook has a retail network in excess of 1700 stores in 390 Chinese cities. China includes Macau (Chinese Vegas!) and Hong Kong. Chow Tai Fook plans to have over 2000 shops by the end of next year. Just to put it into perspective, in terms of outlets, Chow Tai Fook has as many stores as Shoprite has in both South Africa and across the rest of the continent. As per the Shoprite website, 1740 stores in total. Shoprite's annual revenue in 2012 is around 9.4 billion Dollars at the current exchange rate. Chow Tai Fook is lower at 7.3 billion Dollars, but you get where I am going here. Both companies are very well established brands in their relative markets, of roughly an equal size and scale. The market affords a higher earnings multiple to Shoprite, even though Chow Tai Fook has a bigger market cap (much more profitable selling watches and jewellery).

The deal between Chow Tai Fook and Richemont will see the Chinese outfit sell the Richemont brand Baume & Mercier in mainland China. Chow Tai Fook already sells several Richemont brands already, including Cartier. I suspect that this is a smart move for both companies, Richemont will immediately gain a fresh partner in the wholesale market and Chow Tai Fook will offer what is a very exclusive, but yet affordable brand. The watches retail from anywhere under 1000 USD to comfortably 15 times that price. It is probably fair to say that this falls into the category of affordable luxury and probably does appeal to a new entrant into that "aspirational consumer" of luxury items. Sadly, I am not a consumer, I don't even wear a watch. Neither does Byron or Paul.