Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Richemont released a five month sales update this morning and it looks decent enough. The sales per region are always an indicator of who is doing well. However, the sales in Europe have mirrored the real economies, and this is often attributable to the tourist buying. You see, in places like China, where luxury goods are taxed at a higher rate than in Europe, tourists from the East often pick up cheaper products whilst travelling. And of course on the high streets of Europe consumers can be sure that they are getting the finished product. A discerning customer can always spot the genuine product, that goes without saying, not so? This is what the release says: "Europe was strong, particularly in the retail channel in major tourist destinations."

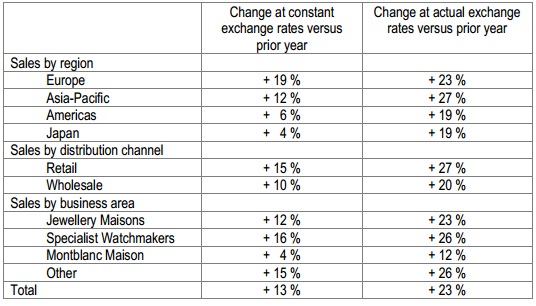

Let us drill into these numbers, there is again a wide variance in the actual exchange rate sales and constant exchange rate sales. Let me hack the sales table from the release, which you can download Richemont announces that its sales for the five months ended 31 August 2012.

Lots of numbers in there, the important part is to know that in constant currencies (Euros in Europe, Dollars in America and Yen in Japan), sales increased by 13 percent. In Euro terms, actual exchange rates, sales grew by 23 percent. Thanks in this case to a much weaker Euro. Over the last five months, since the end of March, the Euro is five and a half percent weaker to the USD. The Euro is ten percent weaker to the Yen. Five percent weaker to the Pound Sterling. So this is a company listed in Zurich, where they use Swiss Francs (pegged at the Euro at the 1.20 level) and possibly most of their products are priced globally in Dollars. You can see where the variance comes in terms of constant currencies and then at the actual exchange rates. In the release, the biggest impact is noted: "The weakening of the euro against the dollar, in particular, had a positive impact on the Group's reported sales."

And then there is of course the associated commentary with the sales tables. Where the company reaffirms their guidance is important, I guess the last four weeks have been no weaker I guess: "We can confirm that operating profit for the six months should be some 20 to 40 % higher than last year, as was anticipated in the announcement made on 6 August." We continue to add to Richemont, we think that the stock is cheap. The company is well run. The two risks that I can identify is that ironically if the European situation improves, the currency headwinds would go against them. And the other is one of the reasons that investors follow the company closely. Johann Rupert might be a South African business legend, but also his family interests have the voting rights ultimately. And I don't know about you, but whenever I watch the earnings releases his fellow directors look more like troopers next to the General. I am sure that all the execs are brilliant, do not get me wrong, but Rupert seems to wield slightly too much power for my liking. This is both positive, as well as a risk for investors. Buy.