Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Notwithstanding the fact that South Africa does not seem to be making headway, relative to the rest of the world, what is making progress is MTN. A business that is only as old as the country is a democracy. 18 years old. In that time the company has managed to attract just short of 176 million subscribers spread across 22 countries across Africa, the Middle East and one in Europe (Cyprus), clock half year revenue of 66.426 billion Rands and register group EBITDA of 29.798 billion Rands. As a listed company the stock has done remarkably well. I remember a time when the company was expensive at 20 Rands, they did not have the earnings to back the price is what the analyst community said. The stock was beaten up, because the company would not "make it" in Nigeria, the analyst community was very sceptical. I swear I remember a time when the cell phone industry was called a "vampire" industry because it leached money from retailers. Now, every single major retailer has a booth with a wide array of mobile phones. Let us just say that communication is hard coded in each and every one of us.

On a per stock basis, adjusted EPS increased 14.3 percent to 537.4 cents. Adjusted EPS excludes once off items, such as amortisation in particular for MTN. The dividend has been hiked to 321 cents. The dividend policy is to pay 30 percent of last years fully adjusted HEPS. The payout ratio for the interim dividend was adjusted subtly upwards to compensate for the dividend taxation.

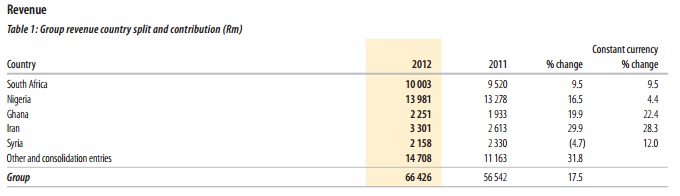

I am going to take quite a few graphics from their results presentation, which you can download here Interim results for the six months ended 30 June 2012. First up, which countries does MTN get the majority of their revenues:

Nigeria and South Africa are still the crown jewels of the overall group number, Nigeria has the most subscribers (43,184 million) and South Africa the third most (23.5 million subscribers). Iran is wedged there in-between, with a whopping 38.3 million subscribers. And then perhaps more importantly, in which of these territories are MTN the most profitable?

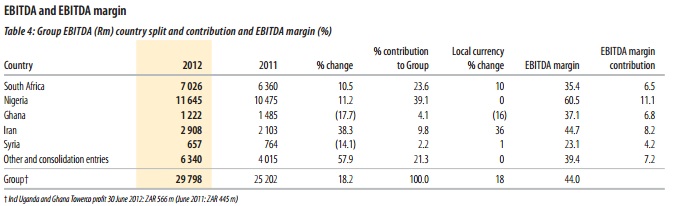

Massive margins in Nigeria, the most profitable part of their business. Collectively the South African and Nigerian businesses contribute 62.7 percent of group EBITDA. These areas remain the focus of the group, most Capital expenditure is being focused on both Nigeria and South Africa in improving the network coverage, with most of the focus on 3G and the quality and capacity. Here it is:

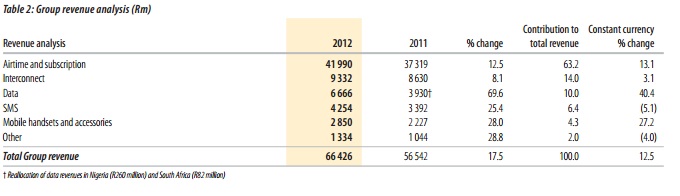

And then lastly, the reason for rolling out the 3G network aggressively is that data, as a percentage of the overall group revenue is now ten percent. SMS is still huge. Interconnect is still huge too! Check at the rate however that data is growing, at nearly 70 percent. We remember scoffing at the notion that the mobile companies were ex-growth, because in our minds with the improving network speeds (and poor quasi government organisation in the form of Telkom), and vastly improved handsets, both high end users and middle of the road users are consuming more and more data. You would have perhaps expected data growth to slow a little, but folks love being connected all the time. Next table, where the overall group gets their revenue from:

You get the picture operationally. Of course there are more than just a few challenges for the company, both Syria and Iran remain problems, and there is some 8.8 billion Rands tied up. And possibly not easily extractable. Clearly they can't extract that, because they would have. And as Paul pointed out, both those local currencies have been under pressure, away from the official rate of course. Sanctions are biting in Iran and there is a bloody civil war in Syria if you needed reminding. There is commentary about Iran that suggests it is tough: "The rollout of some projects has been slower than anticipated because of delayed equipment delivery and the impact of sanctions on certain equipment." Although in their Syrian business commentary MTN are less forthcoming, referring to the "very challenging socio-political environment" and "the current political situation in the country" is impacting the conversion to a full licence.

What should you then expect from MTN then for the balance of the year, as well as for the next few years? For starters the company plans to add 21.250 million subscribers to their group networks, the majority thereof in Iran (5 million) and Nigeria (4 million). The group number was revised slightly lower, mostly as a result of Iranian subscriber predictions being lowered. But we are talking 50 thousand subscriber difference in guidance, negligible. Any business that can add over ten percent new customers in a year is a business to be admired, especially when we are talking these sizeable numbers. The company plans to spend the next six months "maintain(ing) its leadership position with an increased focus on customer experience and countering competition through innovative and relevant products and services."

Their continued roll out of their data infrastructure, in particular in Nigeria is key to them maintaining their longer dated success in that territory. Data revenue grew by a whopping 160.8 percent in Nigeria. There is a pretty poor state service provider, Nitel. It is fair to say that MTN have also benefitted from the poor state competitor. Iran remains a big problem for investors. There is a young population that might not (or might) subscribe to the states political views. It is more than tricky. I do think that the discount is applied for both that business and the Syrian business. It is a mixed bag in terms of the countries, luckily the two best businesses are politically stable. Byron points out that there are only 4.4 million smart phones in South Africa, but 11.9 data users. I am guessing all data users want a smart phone. Nigeria has only 2.6 million smart phone users and 480 thousand dongles. In Syria and Ghana they are trying, but it is still small.

There is also potentially more value unlock as MTN continue to sell the towers infrastructure to America Tower Company, including a recent sale of their business in their Ugandan sites. Whilst we always remain anxious about margins being maintained through their data expansion, everything still looks good, so far. We continue to acquire the shares, and continue to see ourselves holding the stock of what is a really great African success story.