Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Nike delivered their third quarter earnings after the race bell last evening. It was a beat which is all the street really seems to care about I guess, EPS for the quarter clocked 1.20 Dollars versus the streets estimates of around 1.17 Dollars. So a comfortable beat. As much as I care about whether they managed to do better than the analyst community thought they would, I also don't get too excited about that specifically, the pitfalls of contracting quarteritis skew what you are trying to achieve. And what we as investors are trying to achieve is buying quality companies in a sector that we like. Nike happens to fall into an investing theme that we like, aspirational consumerism. Or soft luxury in this case, on the local front we like Richemont, which is at the other end of the spectrum.

Nike managed to grow revenues by 15 percent to 5.8 billion Dollars in Q3 when compared to the corresponding third quarter in 2011, 16 percent better on a currency neutral basis, in other words in same currency sales. Headline earnings increased 7 percent to 560 million Dollars, gross margins were squeezed lower by 200 basis points to a still healthy 43.8 percent. Mostly as a result of higher product costs. There were cost saving initiatives in the form of product cost reductions, whilst more online sales decreased costs too. I have no doubt that whilst many of us are comfortable to shop online, many of us have still yet to embrace the future yet. There was of course some shares purchased in the buy back program, 239 million Dollars was spent on buying back 2.5 million shares, well done guys, you got them below 100 bucks. Current price at last evenings close was 110.99 Dollars per share. Good going. Since the repurchase program was announced in 2008, the company has bought back 48.1 million shares for 3.9 billion Dollars. 1.1 billion left to go, I suspect another five quarters. And average price of around 81.08 Dollars per share, that sounds about right.

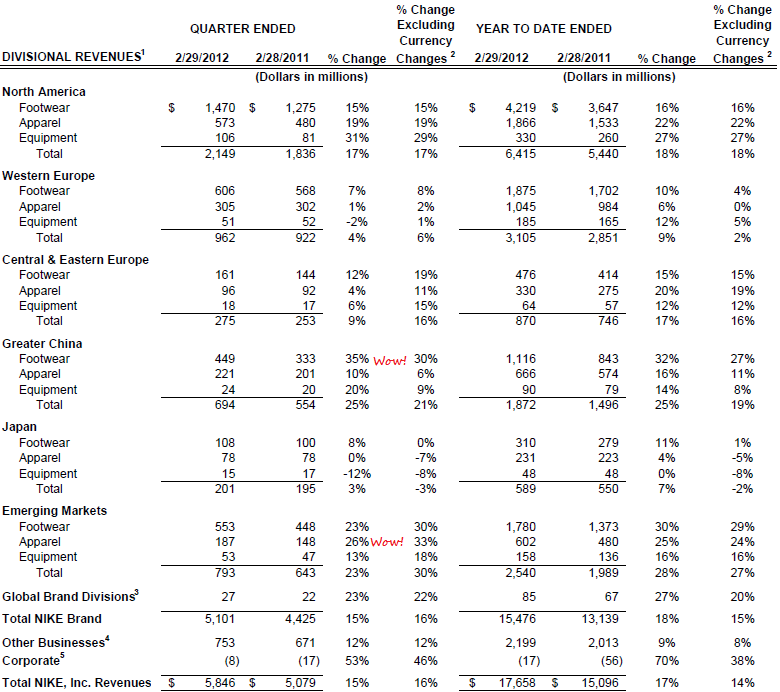

So, sales better, earnings better, margins the only weakness really. And down the line the product pipeline looks really good. The US still is the main part of their business accounting for 2.149 billion Dollars worth of sales, which was a healthy 17 percent increase in regional sales, driven by a 31 percent increase in equipment sales, but more importantly, a strong performance from the core of the group, the footwear (+15 percent) and ever growing apparel (19) divisions. Western Europe, as finished as it is, managed to clock a 4 percent increase in revenue, thanks to a 7 percent jump in footwear sales. Taking to the streets both protesting and getting rid of that frustration, beating the streets I guess. Greater China sales increased 25 percent, with a 35 percent increase in footwear sales driving the overall mix there. Even Japan managed to increase sales by three percent. Emerging markets, which I guess is us increased sales by a whopping 23 percent, much the same as China. Apparel in our segment, not so much in China where I guess you can get cheap clothes all of the time. That is completely Linsane! I mean, you need to find out, if you do not know already about Linsanity.

Take a look for yourself at this graphic that I hacked from their results pdf, which you can find at this link -> CONSOLIDATED FINANCIAL STATEMENTS FOR THE PERIOD ENDED FEBRUARY 29, 2012. The two things to look out for are increased footwear sales in China (Nike shoes!) and apparel in the developing markets, football shirts! Those are growing at breakneck speed. The first two measure the two corresponding quarters against each other, whilst the other two columns are the nine months of the financial year thus far.

Future orders, so that is stuff in the pipeline increased by 18 percent in home based currencies and 14 percent in Dollar terms. And take note of these decent results in a very ordinary year. A very ordinary year across the globe still managed to translate to their main division, footwear, growing revenue by 17 percent. I suspect that as we start to see a little more confidence return, the apparel division should continue to grow even stronger. And if Tiger should emerge from the drought Woods, then expect people to get excited about the golf club buying again. Golf, not for me. But I will beat the streets and kick a ball or two. We continue to accumulate the stock at current levels, even if 23 times earnings looks expensive, it is for a reason, the company is growing exceptionally fast in the poor times.