Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Aspen released results yesterday, for the half year to December. And this is where management must be given a huge pat on the back for a number of things. First, the decision to diversify geographically. At the time I remember people asking questions, like, is this a good idea to leverage up and acquire these businesses, they are doing so well here. Next, the big transaction, the recent one between themselves and the Australian business Sigma, perhaps that is related to the first point, Aspen was seen to be paying up, too much. The Aspen management team are really well regarded, they are top of the pile, I know it is a cliché to say this time after time, but they seem to have the golden touch. And share holders best interests at heart, because they themselves are big shareholders. Perhaps most importantly, while Aspen have been growing like this they have maintained margins. That does not lie, and also it is not a chase revenue at all costs.

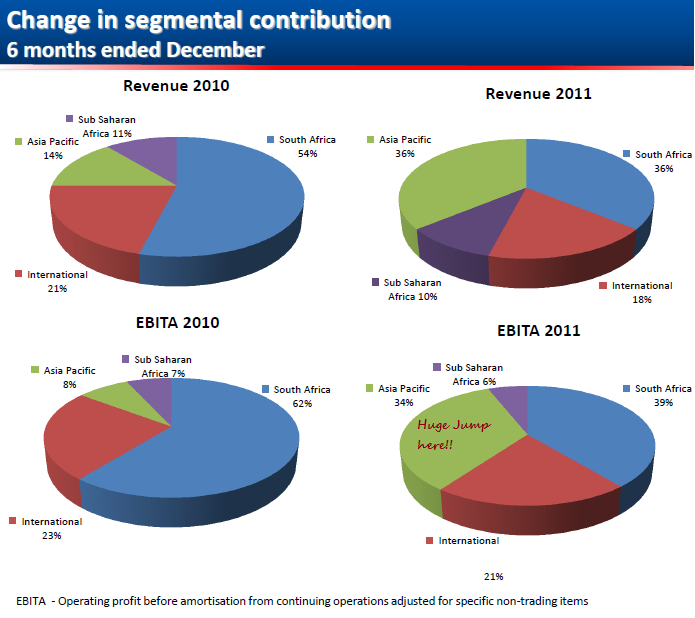

This is, as per the results presentation, this is the 27th consecutive reporting period of unbroken earnings growth. OK, the simple numbers, half year revenues grew 31 percent to 7.505 billion ZAR, with operating profits up 28 percent to 2 billion ZAR (no really, exactly to the third decimal place). That translates to a normalised diluted headline earnings per share number of 308.1 cents. South African cents of course. Profits after tax were 1.346 for the half year. There is a "nice" pie chart that breaks down the revenue and profits contribution that shows you how much the Sigma business is now contributing.

South Africa was the problem region for Aspen. What we see is that management say that there were a number of once off events, namely competition from generics (what a twist), ARV offtake from the government tender much lower as a result of government using donor sponsored products, a licence agreement with Pfizer around baby milk expiring (250 million ZAR revenue), production lost for the entire month of July as a result of a strike and another ARV related problem of lower pricing and lower volumes on government tenders. The two ARV problems are no doubt related, but as donor funds become "tight" the government will have to revert to buying more ARV's from Aspen and the like. The total public sector sales were down 383 million Rand.

I expect margins to always to very slim for the manufacturers of ARV's. Always. Ironically there is a new research that suggests that HIV negative people take the ARV's in order to prevent infection, a WSJ article just today -> Fight Over Use of HIV Drugs. Whoa! Byron suggested that this might be good for one industry only, sometimes termed the world's oldest profession. I object, hunting must be a profession that is older. Amongst many other things.

Back to Aspen, South Africa where revenue was 11 percent lower, profits were understandably lower too, by 17 percent too. Aspen mentions that cost pressures were creeping in, discussing this yesterday we mentioned that almost no South African company is immune. The Asia Pacific business which includes Sigma (4.1 percent of all Australian sales now) for the first time sees revenue roar ahead, and profits almost rival South Africa now. What is also interesting is that the Australian base is being used to expand into the rest of Asia, where there is a whole lot more people. 20 million people in Australia. There are 94 million people in the Philippines where Aspen have just deployed 90 sales people. There are 28 million people in Malaysia and 64 million people in Thailand where Aspen are looking next, according to a radio interview with CEO Stephen Saad. The population numbers I got from Wiki, Saad indicated that Aspen were going to Thailand and Malaysia. I never realised that Malaysia had much fewer people than Thailand. Other countries identified in the region include Vietnam, Indonesia, China and Japan. Vast populations there.

Their Latin American business saw improving margins on slightly higher sales which resulted in better profitability. Sub Saharan Africa, although a small contributor (see pie graph above) to the overall group, continues to make really good progress. Both regions attract the same sort of expansion plans as the Asian business and after much hard work.

What I found quite interesting from the presentation is that South Africans have been net buyers of the stock (over international fund managers) for the first time in a long time. Perhaps finally the 27 odd consecutive growth in earnings reported might have something to do with it. We need more than encouraging down here. And it is a company that looks perpetually expensive, the stock price that is. You know the old value investors line, price is what you pay, value is what you get. That I think is a line that many who link their carriage to the Buffett and Graham steam engines use. This is a stock price that always looks toppy. Even if I annualise these half year number, I get to around 615 cents per share. The stock price is last at 108 ZAR, so the company trades on 17.5 times earnings roughly. And carries a very modest distribution, you are not buying it for that! Even if they grow earnings by twenty percent in their financial year to June 2013, the stock is trading on less than 14.5 times forward.

You are not getting an absolute bargain, but what you do get however is a fantastic track record of beating time after time, an ambitious management team that sees Latin America and Asia as huge opportunities. They are in fact according to themselves the company with the largest pipeline over the next 24 months in South Africa, so the growth of the past should return and the once off problems should be viewed as a speed bump. You know what, the story (listen to me, talking that nonsense talk again) remains compelling and the growth prospects are still there. The stock remains a buy for us.