Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

MTN Group have released results for the full year to end December 2011 this morning. The company has managed to grow their subscriber base for the full year by 16.2 percent to 164.5 million people. Which now means that the total subscriber base is closing in on Nigeria's population of 170 million, that should be breached in the coming months at the next subscriber details release. Revenues for the full year on a constant currency basis were nearly ten percent higher. In Rands, which is where we measure the company, group revenue increased by 6.3 percent to 121.884 billion ZAR. Phew. That is a big number, with Nigeria growing by 4.1 percent, South Africa by 7.7 percent and Iran by a whopping 20.1 percent. Notwithstanding the interconnect fees for all South African operators being much lower, interconnect revenues increased 8.9 percent.

Headline earnings per share increased by 40.5 percent to 1068.6 cents per share, adjusted HEPS increased by a whopping 43.2 percent to 1070 cents per share. The dividend continues to look juicier and juicier, the dividend payout ratio is 70 percent. The final dividend of 476 cents means that you would get 749 cents in total. At the current share price (higher this morning) the company trades on simple fundamentals of 12.8 times historical earnings and a dividend yield of 5.45 percent. Much better looking valuations for this size and scale (256 billion market cap at the close last evening) you will struggle to find. Possibly the biggest surprise (sort of) was the massive buyback, 927.3 million Rand. That is 0.36 percent of the current market cap, the number of shares bought was 6 764 412 shares, I get to an average share purchase price in the last quarter of 137.09 ZAR rounding up. Current price, including the gain today is 137.20 ZAR. Before today they were not in the green. But the buyback itself is a surprise and interesting.

Operating costs increased marginally, well below revenue growth, group EBITDA margins managed to stay flat, that excludes the sale of what MTN refers to as passive Ghanaian infrastructure. That deal was done and dusted there, profits from that sale to American Tower Company yielded 1.185 billion Rand. A new tower company was formed in Uganda in which MTN has a 49 percent stake. American Tower Company, a listed entity on the NYSE owns the other 51 percent and in return paid MTN around 175 million Dollars. Infrastructure can be sold off and part owned or rented. And seemingly this is part of the strategy ahead, to share the risk around with a willing partner like American Tower Company which is looking for growth opportunities in emerging markets. ATC or using their ticker AMT has a market cap of 24.5 billion Dollars. Nearly 190 billion Rand. I wonder what the implications are for American Tower, doing business with a business that operates in Iran. That must be an "issue".

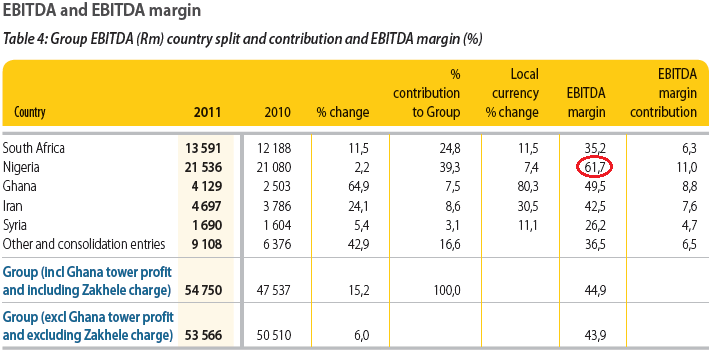

EBIDTA margins in Nigeria are still top of the group by quite some margin, have a look at the big contributions as per a slide in the presentation:

Don't get too excited about the Ghanaian contribution, that includes the sale of 1800 plus towers of course.

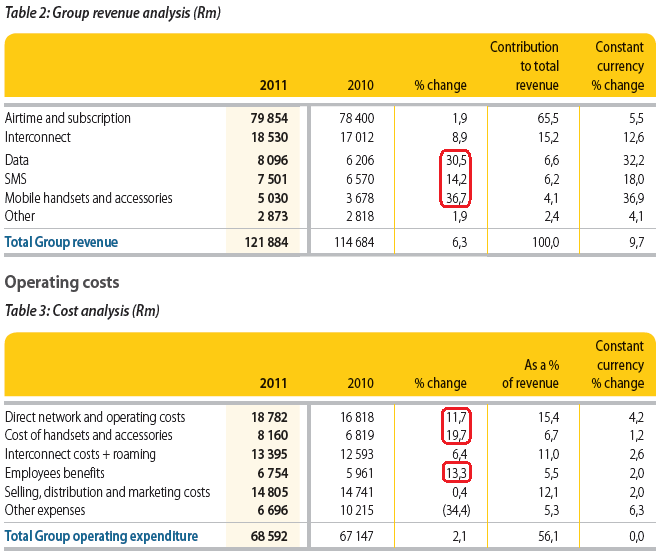

I took a screen grab of a very important slide (I did hack and slice the original), group revenue analysis and cost analysis on the slide four of the presentation package for Audited results for the year ended 31 December 2011.

The fastest growing revenue segments, the ones growing double digits or more are data as we have always suggested, which makes up 6.6 percent of total sales and handsets as folks want fancier smartphones that ironically use more data. So the two are linked of course, but collectively are still small from an overall revenue contribution (10.7 percent), but we continue to see this as a growth area for MTN. SMS is still a very important means of communication across Africa. Can you still see how important the interconnect fees are however? Just over two and a quarter times bigger than data sales. The big daddy of them all however are voice calls, 65.5 percent of the revenues are made up of subscription and airtime sales. So depending on your view of how this is going to evolve over time, that will depend on your view on MTN. And of course the data revenues, what percentage of sales is that going to be in the coming years. The group say in their presentation that "Coordinated data and related services remains a priority" This obviously also refers to the mobile money platform, that has attracted 6 million users in 12 of their countries.

In the country review, I found the data explosion in Nigeria only the start of what I expect to come: "Data revenue (excluding sms) grew 105% as more data packages were introduced to the market. MTN Nigeria has 1,7 million smartphones and 330 000 dongles on the network." Whoa! So as there are more internet users, using more smartphones, data usage should continue to grow. Perhaps not as much as this. Data revenue in Ghana grew 79.7 percent. Data revenue in Iran grew 66.5 percent. Admittedly these are all off low bases, but as it turns out, everyone wants mobile internet and a smartphone.

The information about the hot spot regions and prickly issues, Iran and Syria and the like is dealt with diplomatically: "Political unrest in the Middle East remains a concern. There has been an impact on the business environments in Yemen and Syria and MTN will continue to monitor both situations closely. Business in Iran remains buoyant, but MTN continues to be sensitive to the international issues relating to Iran whilst retaining its firm commitment to its operations there. In partnership with its legal advisors, MTN continues to ensure that it remains compliant with the various sanctions regimes in place." Well said.

What are the other risks when owning shares of MTN? Other than the obvious country risks mentioned above? Well, there are the pricing wars that of course happened in East Africa, in particular Kenya, the effective tariffs in Dollar terms are falling, but profit margins are maintained by much higher volume usage. I suspect however that the base is still low in an African environment, with GDP growth rates for sub Saharan Africa set to be close to 6 percent, that bodes well for many companies operating here. And remember one very key thing about fixed line operators outside of our borders. As rubbish as you think the local provider is here from a service point of view, at least the option exists. It is almost as if the fixed line infrastructure was skipped in favour of mobile. And that makes sense, it is easier.

The prospects are as follows: "MTN remains cautiously optimistic about the year ahead with macroeconomic conditions in key markets not expected to change significantly. The key focus areas over the year are to maintain and improve our market position and improve customer experience. There will be continued effort to strengthen our position in non-voice services in all markets."

That sounds kind of cautious, not so, but they say as much? And then in the same breath, they are expecting to add over 20 million subscribers. That is a customer growth of over 12 percent. How many businesses do you know that are expecting off this base to add over ten percent to their customer base? Ex growth? I am not too sure, revenue growth won't be what it was, but we know that. We continue to accumulate the stock as the valuations are still very attractive to us.