Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

BHP Billiton this morning have announced a MAJOR INVESTMENT AND RESERVE INCREASE AT ESCONDIDA. Cast your mind back to the results at the beginning of last week, when we spoke about the fall off in profits from this operation specifically. And how, it was actually the swing between what would have been marginally lower earnings, and what would have been very good earnings, had the operation delivered the same performance as the year prior.

Last week we had Visa report first quarter earnings for the period ending 31 December 2011. And as we have come to expect from this company we saw good growth in revenue and margins. Revenues came in at $2.5bn which equated to net income of $1bn. How's that for a profitable business. This equated to $1.49 a share for the quarter.

CEO Joe Saunders had the following to say. "Visa's core businesses drove a strong start to fiscal 2012. We achieved solid financial and operational performance as we continued to benefit from the secular shift to electronic payments. Consumers' desire to use our products is evident in the strong growth we see outside the U.S. and the resiliency we are seeing in the U.S. in the wake of debit regulation. We remain intensely focused on further growing our international business, partnering with financial institutions, merchants, technology providers and governments, At the same time, we are moving forward on our innovation strategy and are working side by side with our financial institution and merchant clients to deliver the products and solutions that best drive our mutual success."

There is no doubt in my mind that this is a fantastic business but sometimes good businesses can still be too expensive. The stock trades at $112 and a historic PE of 29. The company is expected to make $5.95 this year, $7.17 in 2013 and $8.25 in 2014. These high expectations puts the valuation at 13.5 times 2014 earnings.

I feel this company deserves its higher rating and wouldn't be surprised if they beat these earnings expectations. Their business model is that good. No credit risk like the banks, exposure to a strong global consumer and a shifting revolution in the way we purchase our goods. They are also innovating and will be at the forefront of new payment methods like mobiles and online banking.

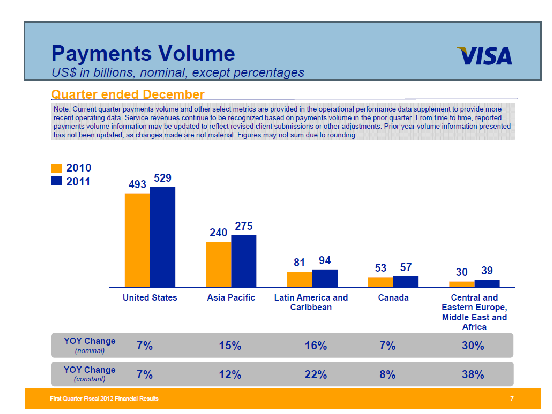

How is this for a phenomenal statistic. Payment volume through Visa's amazing systems amounted to $971bn, up 13% on the prior period. Let's say they manage to grow this figure modestly each quarter this year, they will end up processing around $4 trillion. That is like processing the equivalent of Germany, South Africa and Sweden's entire GDP put together.

In terms of growth, like most of the big multinationals we've been looking at, it is coming from the developing market. Especially in terms of debit transactions which is still a fairly new concept in the developing world. The US which is still responsible for 55% of all Visa transactions is still maintaining good growth off such a high base. Here is the geographic breakup.

The share price is up 50% in a year and trading at all time highs. This shouldn't deter you, Apple was also trading at all time highs in 2009 at $200. They've recently breached $500. We like the company and feel the share price still offers good value. Happy to add.