Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Yesterday we had loads of exciting companies releasing their quarterly earnings. One of those was Johnson & Johnson who reported adjusted earnings which beat forecasts. I say adjusted because they had big legal settlements and product liability costs. Unfortunately that is one of the risks when investing in a big pharmaceutical business.

So let's delve into the numbers straight away and then we can look at the whole mix. EPS for the quarter came in at $1.13, above consensus of $1.10. This was from revenue of $16.3 bn. Margins have been cramped somewhat due to increases in R&D but still a very profitable business with operating margins of 20.3% and gross margins of 67.2%. Guidance from management expect earnings for 2012 to come in between $5.05-$5.15. The stock trades at $65 so we looking at a forward PE of around 12.75. Not cheap but certainly not expensive for a company that yields 3.5%.

So how did sales go per segment? This info is for the year where the group had sales of $65bn. 40% of JNJ sales comes from Medical devices and diagnostics. This includes medical equipment which falls under three business groups. Global Surgery Group, Global Medical Solutions Group and Global Orthopaedics Group. These all experienced good growth in the BRIC nations where they are applying much of their focus. They are the number one supplier in this field and have lots of innovative new products in the pipeline. This business is responsible for 44% of profits.

23% of JNJ's sales came from Consumer products. We are all very aware of these products such as Vaseline and endless skin and baby products. Sales for the year were pretty flat in this segment. Again much focus was put into expanding into the developed markets as well as maintaining their iconic brands. The margins in this business are not nearly as good as the other businesses so the sector is only responsible for 11.5% of profits.

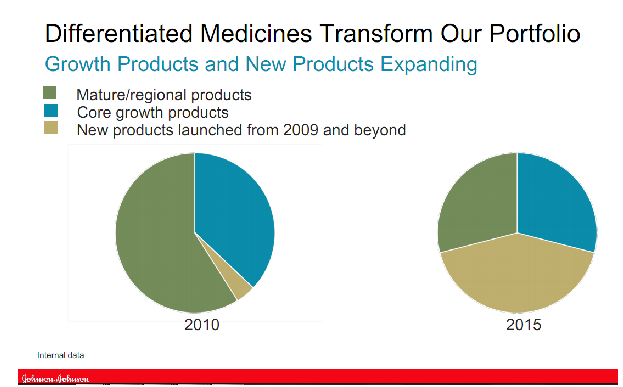

Pharmaceuticals were responsible for 37% of sales and 44% of profits. Sales grew by 6.2% in this division. Here is how they see their mix by 2015.

Check how important new products are going to be. This is why an increased in R&D spend is so significant. It is an extremely competitive world out there, just like the tech stocks and one needs to be innovating all the time. Great for the consumer.

All in all a good mix. They need to maintain their reputation and stay away from legal suits which have hampered them this quarter. The analyst community seem very excited about their pharma division with new products bringing in a lot of potential. We like the sector, populations in the developed world are aging and populations in the developing world are able to afford more healthcare as they get wealthier. Johnson & Johnson are one the best in the sector and at current levels offer good value.