Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

A whole host of results yesterday, but after hours there were results from Google inc. for the fourth quarter, and both the top and bottom line missed expectations. Which is not good, but there were some factors, some unavoidable. A stronger US Dollar eroded international sales, there was a fall off in ad click prices, but perhaps more importantly costs continued to rise and are now nearly one third of all revenue. Check out the press release: Google Announces Fourth Quarter and Fiscal Year 2011 Results where the opening line kind of detracts from where the share price is trading in the extended market, commentary from Larry Page:

"Google had a really strong quarter ending a great year. Full year revenue was up 29%, and our quarterly revenue blew past the $10 billion mark for the first time, I am super excited about the growth of Android, Gmail, and Google+, which now has 90 million users globally - well over double what I announced just three months ago. By building a meaningful relationship with our users through Google+ we will create amazing experiences across our services. I'm very excited about what we can do in 2012 - there are tremendous opportunities to help users and grow our business."

Yeah. Unfortunately for Page and other Google shareholders, the stock is down 9 percent post the market. A miss is a miss, there is no other way to explain that. Folks are paring back their lofty expectations, you have to expect that to happen when you hold shares of this nature. OK, but because it was the full year, we can compare their business to 2010. Net income in 2011 came in at 9.737 billion Dollars, better than the 8.5 billion in 2010. The top line grew to 37.9 billion Dollars from the 29.3 billion in 2010, but the all important total costs and expenses (including stock based compensation) increased from 18.9 billion Dollars in 2010 to 26.1 billion Dollars in 2011. A big(ish) jump in R&D, as they explore new businesses, this is the nature of the beast.

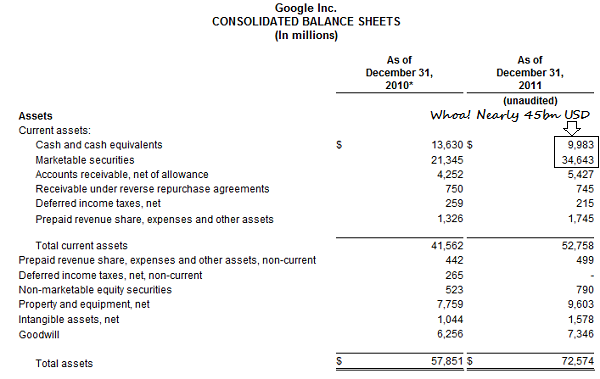

Check out how much cash they have:

If they were to open now, down that nine odd percent as the pre market suggests, then if you minus the cash, cash equivalents and marketable securities (nearly 45 billion dollars) you get a market cap of around 144 billion Dollars, which means ex the cash you are paying just short of 15 times earnings. Question is, is that too much? Methinks not at all. The rising costs are of concern, but Google is diversifying their business, they still have powerful free cash flow (which does not lie), around three billion Dollars every quarter. We will use the price collapse as an opportunity, I am already starting to see the same suggestions from elsewhere.