Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

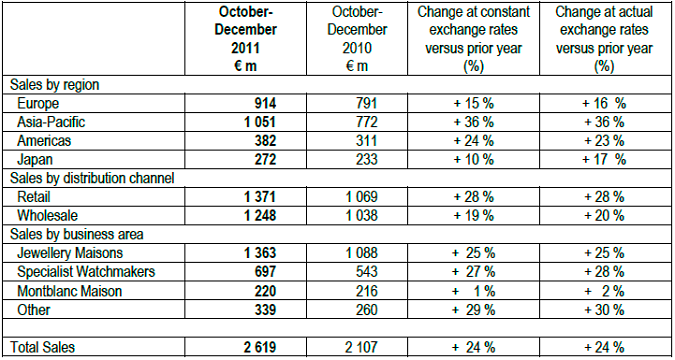

Richemont third quarter sales have hit the screens this morning. They are great. Well, at least I think that they are great all things considered. The highlights: "Sales in the quarter increased by 24 % at actual and constant exchange rates.". Highlight. OK, so here is the table of sales and it is very important to note that for the very first time in this quarter, sales in Asia Pacific have overtaken sales in Europe. So, in short, their most important sales area is not the traditional old world, but rather the new world. And the new world has three things going for it, a large population, the base was low and is expanding fast and the future is brighter. Check it out:

What we often say here in our office is the obvious, that European sales might not actually reflect locals purchasing, but rather visitors to the region. This is made clear again, in the official release - Trading statement for the three months ended 31 December 2011: "Sales growth in Europe, which includes the Middle East and Russia, benefitted from purchases made by travellers." Of course this means that Asian buyers and tourists visiting the old world are probably far more influential than the numbers reflect.

What is quite interesting too is that the cash position continues to grow, at the end of the year it was 2.9 billion Euros. The market cap as at the close on Friday was 225 billion ZAR. The cash in Rand terms (at 10.32 to the Euro) is nearly 30 billion. 13.3 percent of the market cap. And there is not much debt. OK, that is badly put, as per their annual report last year: "Richemont's financial structure remains very strong, with minimal debt and shareholders' equity representing 72 % of total equity and liabilities." Strong cash flows, shrewd management, a very desirable product, we suspect that earnings will continue to trump expectations. I am not too keen on the Purdey shotguns and rifles, but I approve of all of their other brands. The trick will be to maintain margins in these tricky times.

As ever, the Chief Executive remains cautious: "As expected, the slowdown in sales growth relative to the first six months of the current financial year reflects a combination of more demanding comparative figures as well as the volatile and challenging economic environment. Sales in the month of December were 21 % above the prior period at actual and constant exchange rates." Notwithstanding that cautious optimism, we are bullish and are buyers of the stock.