Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Richemont results this morning!! I hardly slept last night, I was so excited about these. No, I cannot tell a lie. I do sleep pretty well. They pretty much tell it like it is in their release -> Richemont, the Swiss luxury goods group, announces its unaudited consolidated results for the six month period ended 30 September 2011.

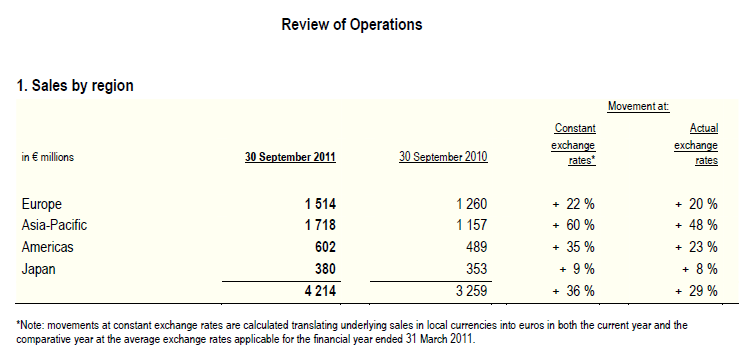

Sales increased 29 percent to 4.214 billion Euros, or at constant exchange rates by 36 percent. And there I thought the Euro was finished? Operating profit topped 1 billion for the first time, up 41 percent to 1.075 bn Euros. Basic earnings per share increased to 1.29 Euros per share, the GDR here is a ten for one, so that translates to 12.9 Euro cents. That is just shy of 1.4 ZAR for the first half of the year. Presuming they manage to deliver around 290 to 300 ZA cents for the full year, that makes the stock looks cheap(ish) at 14.6 times forward earnings. Gross margins decreased by 160 basis points to 63.2 percent, but operating margins increased by 220 basis points to 25.5 percent. Sigh, most people would be really envious with those types of margins. Expenses as a percentage of sales decreased to 38 percent from 42 percent in the corresponding reporting period. Cash on hand increased to 2.596 billion Euros. That is over 28 billion Rands worth of cash. Phew. Here is a hacked table from that release, which gives you the regional sales.

Pretend for a moment that you had not been watching the TV for the better part of a year and a half. You see Asian sales grow a whopping 60 percent. European sales growing by 22 percent. Heck, even the stagnant Japan is growing at 9 percent. Does this look even remotely like heading for a double dip recession? No. And for the first time, Asian sales have smoked European sales. And is now their most important region by sales.

BUT wait. Rupert the bear, I mean Johann Rupert is always cautious. Always. And warns that the outlook is not as rosy as you may think (but that is alright, you do not anyhow), check it out -> "For the second half of the financial year, we face both the impact of global economic problems on the luxury goods industry in general, and the demanding comparative figures against which Group sales will be measured." Yip, this is true, and we are not reading anything new. However, he (Rupert) continues -> ".... our confidence in our business model and the strength of our balance sheet will enable us to continue to invest in our businesses for the long-term, despite the very worrying world economic environment."

He is almost always bearishly optimistic. But he is a good operator and that held him in good stead through the last financial crisis, where the company emerged a whole lot stronger. We will continue to buy the shares of the company, the stock is higher, over two percent today, at the get go. Europe at the time of writing is not open as of yet. We like the theme, we can appreciate that the situation in the developed world looks very average right now, but the Asian sales growth should more than offset softer growth in the traditional areas. Oh yes, and a China new loans number just released has crunched economists' forecasts. Strange that.