Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Some results to have hit the screens yesterday includes one of our recommended stocks, Aspen. These were the results for the full year to end June. Paul is actually at the results presentation (yes, this is unusual for us) and will come back with some further insight I guess, which we can add to tomorrow. So first up, a look at the numbers. Revenue increased by 29 percent to 12,4 billion ZAR, operating profits increased by 25 percent to 3.1 billion ZAR. There was a significant acquisition in the year, Sigma in Australia, so the numbers given are for normalised earnings, which came in per share at 523.3 cents per share. Up 20 percent and in line with the trading update, so no surprises. After a pause in the distribution in 2009, the company is back with a share premium of 105 cents being declared.

In their primary and original market, South Africa, the going has been really tough, Stephen Saad, the highly regarded chief executive summed it up in the results release: "The South African performance was particularly pleasing given the headwinds in the market, namely a 0% increase in selling prices, but cost increases in salaries, wages and electricity. This vindicates our strategic investment in manufacturing infrastructure."

They managed to increase sales in South Africa by 13 percent to 6.3 billion ZAR, and operating profits by 17 percent, to 1.9 billion ZAR. You can quite quickly see that South Africa is their most profitable region, notwithstanding their expansion. Their international division grew revenues by 56 percent to 5.6 billion ZAR. There was, as we mentioned before the Sigma acquisition, that was 863 million Aussie Dollars, 5.9 billion ZAR.

There is however for the first time a shift, the prospects column tells you that: "During the forthcoming year, revenue and profit contributions from the Group's International businesses are expected to exceed that of the South African business for the first time."

This was interesting, really interesting. "The Group's pipeline for Australia has been further augmented by the conclusion of an agreement with Cipla, the leading Indian generic company, to work together for Aspen to launch Cipla developed products in Australia." That tells me everything I need to know about Cipla Medpro here, it is just a distribution agreement. Wow.

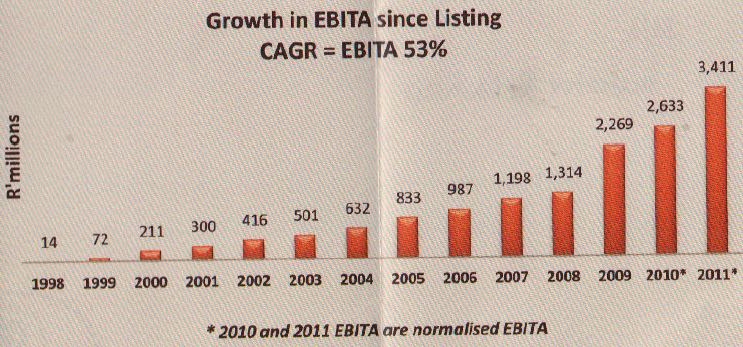

Paul came back from the presentation and took out what he thought was the best page, I took one slide from that page, and that tells you all that you need to know:

The question of course is, can they keep it up? Clearly not at this pace. But their tie up with GSK is key in growing in emerging markets that GSK might not want to operate in. Sigma are going to start contributing heavily, Paul said in fact that the team in Australia were so good, that Stephen Saad has only been there twice since the acquisition. The goal is to use that (Sigma) as the base for Asia Pacific. They have done a fairly good cleanup, they are left with a single manufacturing facility, the others have been cleaned out. They have also sold the old industrial manufacturing facilities and shut down the head office in Melbourne. Only something that you can do if you are ruthless. They are not standing still in their other geographies, expansion plans in Latin America are also on the cards.

They have also started to sell some lines in their consumer business here locally, indicating that they are going to be focusing on the higher margin business. So think, less J&J and more Teva. That sort of thing. We are happy to continue to accumulate the stock, we have great faith in management execution. The stock has sold off a little today, but we think that is an opportunity to start building a bigger position, we are predicting that you will be well rewarded in time.