Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

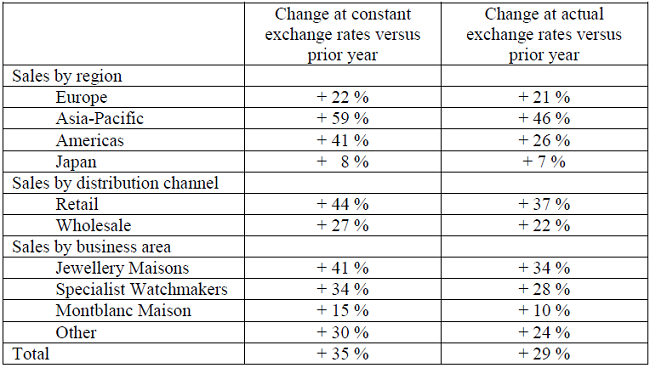

Richemont are out with sales for five months to end 31 August, and I must admit, they look pretty impressive to me. They are better than I would have expected against the noise that we are seeing out there, again this seeming disconnect between what companies are reporting and what the economic "situation" is on the ground. I am going to take a screen grab from their release:

Note, something that we do talk about, the sales in Europe boosted by visiting tourists, which is noted by the company: "sales growth in Europe was robust, reflecting purchases made by local clients as well as travellers." Huh!? Just turn the business channels on and you will hear how completely awful things are in Europe, you would swear that they were almost starving. And not able to afford luxury goods, but there you go, sales in Europe increased on a constant currency basis by 22 percent. 22 percent? Yes, things are so bad.

But it is not all roses. The ever cautious (although optimistic) Johann Rupert had this to say about the Swiss Franc's drag on their business: