Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Richemont results this morning. This is for the full year to end March. And the results are as sparkling as some of their jewellery items. Sales for the full year 2011 are 33 percent higher than the prior reporting period, coming in at 6.892 billion Euros. Gross profits are 38 percent better, with gross margins widening by 210 basis points to 63.7 percent. Yowsers, nice to have those types of margins. Operating profits were 63 percent higher to 1.355 billion Euros. Operating margin is an eye popping 19.7 percent, a whole 370 basis points better than last year. Credit to management for having read it right, well done. The dividend (which irritates South African shareholders) basically comes to 4.5 Swiss Franc cents. Which is just over 35 ZA cents. Sad face. In a Swiss environment where they are principally listed, this yield is about good enough.

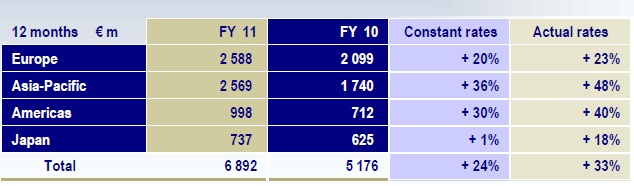

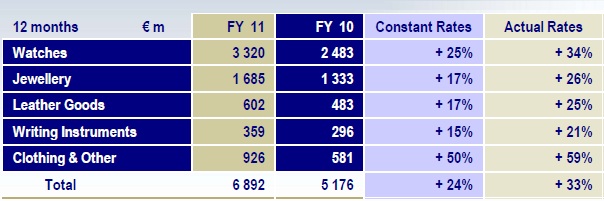

Check out the full presentation: Annual Results FY 11. Amazing overview on their divisions, with record profits at the two majors, jewellery and watches. Wholesale and retail are exactly half and half of overall sales. Here is a look at regional sales, the Asia Pacific region just piped at the post by a strong performance from Europe. Check it out:

See that, Europe is so finished that people only bought 20 percent more Richemont product. Perhaps those are Chinese tourists lining the streets of Europe and they just cannot wait to get a fancy new watch or necklace. And then a strong performance from their major divisions, but also interesting to note that clothing and other becoming a whole lot more important in the overall sales mix.

The store network grew by 69 to 1468 stores overall, the strongest growth came in the Cartier brand. Interestingly, strong internal growth, less so on the franchised side, which indicates that the company is taking a view. But what is the matter? The stock is down over five percent this morning. The main reason given in an early analyst note that I saw was an earnings miss. Costs playing quite a key role in margins not increasing as much as anticipated, a ramp up in fixed investments.

Expectations were very high for these set of results, but we expect sales to continue to grow at a fast pace. We would think that this pull back in the price presents us with a buying opportunity over the coming days, including today of course. We maintain our buy recommendation on the stock. A mere five years ago sales in Asia Pacific were half of what they were in Europe, now the sales for the two regions are exactly the same. That will continue to be the key drivers for sales over the next half a decade or so, with a new rich elite emerging in our favourite emerging markets around the globe, we remain long term buyers.