Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

AngloGold Ashanti out with quarterlies this morning. Fantastic, debt reduction by 200 million US Dollars on the quarter. The hedge noose or hedge yoke is gone. And now the time to wind down all this debt is here. Crossed fingers for higher gold prices for a while still. Production of 1.039 million ounces of Gold, AND 681 thousand ounces of silver. Plus of course 365 thousand pounds of uranium for the quarter. Adjusted HEPS of 53 US cents which translates to 350 odd South African cents per share. Not bad I guess. Total cash costs contained at 200 thousand ZAR per kilogram.

But perhaps we should apply the same exercise to AngloGold Ashanti that we did with Harmony Gold last week, it is only fair that we look at how they have done over a decade. Remember this one from Harmony last week comparing the quarter now relative to where it was ten years ago.

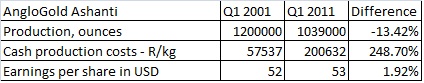

OK, here is the same comparison done for AngloGold Ashanti, taking into consideration that both companies are very different from what they used to be.

OK, this is so far from scientific now with regards to AngloGold Ashanti, because the Ashanti part was not even finalised until early 2004. This was not even a consideration back then, Ashanti. So the extra production and costs would have been added on to the existing ounces produced. And there would have been more shares in issue now than there was way back then. And do not forget the costly unwind of the hedge book.

But costs nevertheless have risen whilst ounces produced (with the extra Ashanti) have decreased. That is the point that I think I am trying to make here, without a rapidly increasing gold price "things" would look a whole lot worse. I cant wait for the other quarterlies to do a similar comparison. Now I am excited. We are not buyers of gold companies as we maintain that costs and production issues are going to remain an issue. Avoid for now.