Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Nike reported afterhours Thursday, we ran out of time Friday to have a proper look. Sadly the numbers clearly disappointed the market. A few things here, first an earnings miss of 4 cents to 1.08 USD per share for the quarter. And then an inventory rise, by 18 percent to 2.5 billion USD. The second part was seen as a poor showing. So even if the company gets really excited about a record quarter, the rising inventory and earnings miss is a little troubling. But let us not get quarteritis, and flip flop from one quarter to the next.

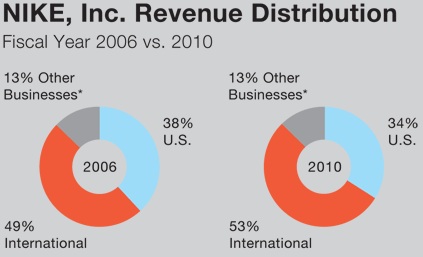

Why do we own the stock in the first place? The category that Nike falls into is aspirational consumerism. Or, as we have decided to shorten it to, "a bling stock". Check out from the last annual report, a graphic that shows how Nike sales are expanding outside of the US, quite quickly:

So, a lot has changed over the last five years, just from a revenue point of view. This time though, prices are rising. The cost of transporting their goods around is rising. The input costs, cotton and labour are rising. Nike has some awesome sponsorships and make the most amazing shoes and apparel. As a customer I have never been disappointed and you pay for quality. At fifteen times forward we are suggesting for a growth stock of this nature the price is good. And don't forget the 31 cents a quarter dividend either, which puts them on a dividend yield of 1.7 percent, hardly a Kings ransom, but look on the bright side, better than Citi.

I agree solidly with this analysis and see this as a buying opportunity ---> Long-Term Investors Should Look At Nike (NKE)