Richemont was caned yesterday too. And is getting a big thrashing again today. I trawled through the 2010 annual report to find what I was looking for, the sales in "JAPAN: The Japanese market, Richemont's second largest single market with 12 per cent of Group sales, remained challenging throughout the year for luxury businesses generally. Yen-denominated sales declined by 17 per cent. The appreciation of the yen over the period softened the decline to 10 per cent in euro terms."

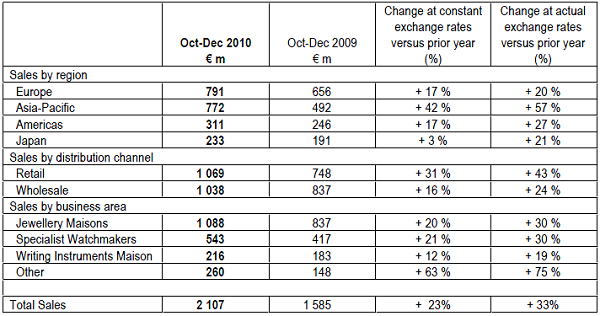

So the market is important, if not as important as it used to be for them. I was thinking that even if sales in Japan slumped worst case scenario, with total Richemont sales down thirty percent, that would be around four percent of group sales. Do you remember this graphic from the quarterly sales period on the 17th of January this year:

Check how the most important region will be Asia Pacific by the end of the year. Japan grew only four percent, whereas that region (Asia Pacific) grew by 43 percent. Even if that region were to only grow by 10 percent, that would offset the Japanese fall. And that is the smarts of Johann Rupert. To have recognized that the one region was faltering and that the other was hungry for luxury goods. Based on this information, I would be advocating that if you have the cash, buy Richemont today. The stock is down another 5.6 percent today and is at 35.60 ZAR.