Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

That is most Ayoba. I am referring to the MTN results for the full year to end December. Released this morning, it was telegraphed of course with the trading statement last week. What stands out immediately for me is the dividend. I did not expect a 55 percent payout ratio, I must be honest. That sounds like a little more than a lot of people might have expected.

The score sheet. Let us dive straight into the numbers here. Adjusted headline earnings per share up at 909 cents, that is 20.5 percent higher, but does exclude the Zakhele share deal. The final dividend of 349 cents bring the full year number to 500 cents a share. This is over 12 times the dividend payout in 2004. Got that? If you bought it back then in 2004 (if you were lucky) then you would have seen your dividend payout grow by a factor of 12. And now I think at these levels, the stock does take on a new dynamic. You cannot say anymore, well, I am happy to own Vodacom because their dividend is better. Now it is similar. And you know what our investment case is on MTN, we will deal with that in the conclusion part.

Margins increased, that is a huge score, so much for the squeeze that everyone was looking out for. Subscribers for the full year were up 22 percent to a whopping 141.6 million. Wow. At September 2004 the number of subscribers was 11 million and that had increased 40 percent. So there has been a bigger subscriber increase than a dividend increase over the same period. Subscriber guidance for this year is 16.9 million folks, largely driven by "the rest" (6.4 million) and then Nigeria (4.2 million), Iran (3.35 million), South Africa (2 million). Get that, in the coming year MTN are looking to add 50 percent more subscribers than the whole group had back in 2004.

The stronger Rand also impacts not only the exporters, but also MTN. Rand revenue increased only two and a half percent to over 114 billion Rand, remembering that 68 percent of their overall revenues are now derived outside of the country. Operating costs actually fell two and a half percent, the group has this to say: "The decrease in costs in the year was mainly due to the decrease in interconnect costs together with a reduction in selling, distribution and marketing costs.". EBIDTA margins, excluding the Zakhele costs were a whopping 44 percent, up 2.9 percent.

Interconnect revenue fell 13 percent, this is pretty well documented. Group data revenue grew to 6.2 billion ZAR, so still smalls of the overall revenue line. You might or might not be pleased to know that the Capex bill authorised for 2011 is set to be 22.131 billion ZAR. The 2010 actual capital expenditure bill was lower than the group anticipated and was over 50 percent lower than in 2009, thanks to the stronger Rand. You see, that helped, because some of the other countries that MTN are committing money to use Dollars and the local unit. But for all intents and purposes, US Dollars.

It begs the question though, if 68 percent of revenue is derived from outside South Africa, and that should continue to rise, just when will we see a listing somewhere else? Or they should start declaring their results in Dollars, move to Dubai or something like that. Or not. But you get the sense of where I am going here, perhaps MTN would be accused of being unpatriotic. Hmmmm.

The mobile payments system (MobileMoney) now is in 11 of the 21 operating geographies and has 4.3 million subscribers. Mobile payments are huge in East Africa and no doubt MTN are looking to replicate that in West Africa.

A JV with American Towers in Ghana was concluded. Now this is very interesting, and is something that no doubt will start to happen across their operations. Let me try and explain. The towers in Ghana will be 51 percent owned by American Towers (they paid 218 million US Dollars for that stake) and MTN will own the balance. I worked out that America Towers paid roughly 228 thousand Dollars a tower (1876 towers in the sale). Or 1.575 million Rand a tower. So, quite simply, you can do the math on their entire network to see what potentially the unlock of cash could be.

Onto the Average Revenues Per User (ARPU) trends and subscribers overall, two of the most important factors when looking at businesses like MTN. In South Africa blended ARPU's are ticking up as prepaid customers are turned into post paid ones. That is the key you see. So, the trend should spread across to their other geographies as the markets mature. So, I don't worry too much about the flattening ARPU's across some of their other big subscriber bases.

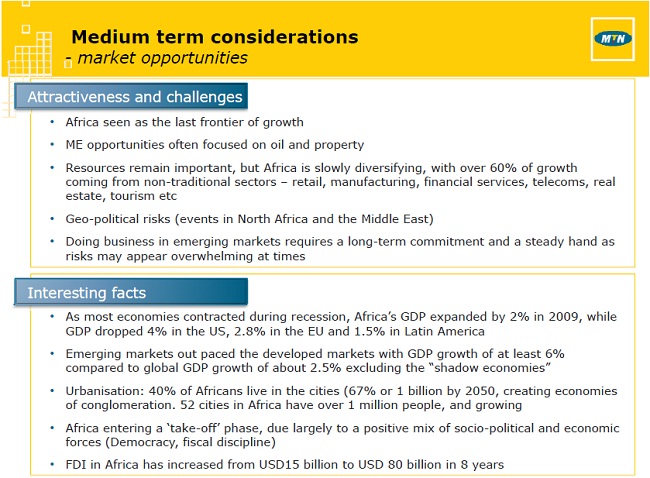

Investment case for MTN. There was a fantastic slide which included a few points that I am going to regurgitate, the "interesting facts" section. In fact, let me publish the image, because these are some of the reasons why we find MTN so attractive:

I suspect that the last two points are pretty key, because the second last might have run into a speed bump in the short term. As Paul called it on his new show Mad Markets on CNBC (20:30 Tuesday nights, there I punted it again) "the freedom virus" has spread. This in the long run is good for these economies, democracy increases FDI, FDI creates jobs, more jobs create greater social wealth.

Investment case against MTN. The regulatory environment is murky at best. ICASA flip flops here, I can only imagine what it must be like in some of the "more interesting" places. Plus, let us be honest, some of the places they operate could potentially be political hot potatoes. Iran. Nigeria is volatile too. Afghanistan. Syria. This is a worry, but I suspect already discounted into the current share price.

The one man jury. Data is going to be huge, and grow off a low base. Mobile penetration in even Nigeria is under 50 percent. So, notwithstanding all the margin compression issues that market participants have agonised about, we believe that the company is still in a stage where transformation will mean greater returns for shareholders. In ten years time we suspect that there will be many, many more smartphone users on post paid packages using their handsets a whole lot more than before. We continue to recommend the stock as a buy.