Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Last night, Nvidia reported quarterly revenue of $44 billion, up 69%, and profits of $20 billion. These spectacular numbers would have been even stronger if they hadn't taken a $4.5 billion loss on chips designed for the Chinese market, now blocked by the US government. That inventory will have to be destroyed.

For the next quarter, Nvidia expects sales of $45 billion, which includes an $8 billion headwind due to lost Chinese sales.

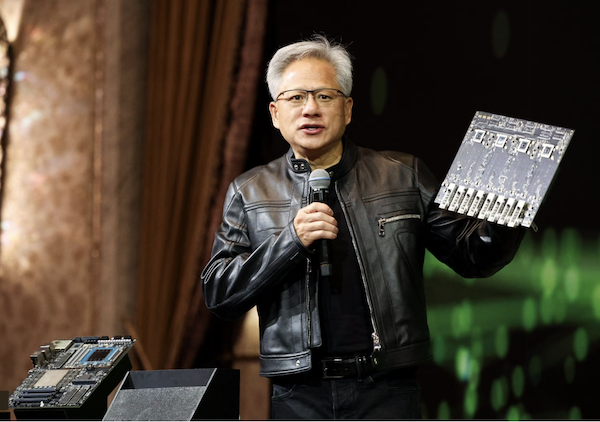

Jensen Huang, Nvidia's CEO, told shareholders last night that he expects China to become a $50 billion a year AI-accelerator market, which, if Nvidia isn't allowed to participate, will allow other companies to fill the gap. 'Giving' all the business to competitors would be bad for Nvidia and detract from the US's lead in AI technology and capabilities.

Nvidia is more than just a GPU producer, they also make the infrastructure to connect all the chips. They just unveiled NVLink Spine, which can handle 130TB of data per second, more data than the internet. These NVLink Spines go into data centres to enable banks of Nvidia GPUs to talk to each other. There is no use having a very fast GPU if it can't effectively work together with other GPUs. Thanks to the ecosystem, Nvidia has an impressive moat against competitors.

This fiscal year, the company will approach $200 billion in annual sales, up from $27 billion just two years ago. The growth isn't expected to slow now that countries are racing to build their own sovereign AI capabilities.

We are happy holders of this stock in our client portfolios, obviously.