Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

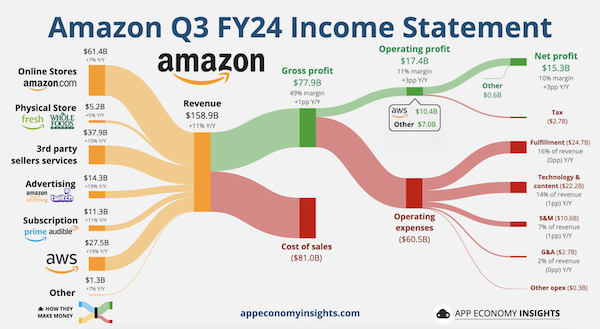

Amazon reported an impressive quarter last week, showcasing the benefits of its well-diversified business model, cost-cutting and AI innovation. Total revenue rose 11% to $159 billion, surpassing estimates, driven by strong growth across Amazon's e-commerce, cloud services, and advertising operations.

Amazon Web Services (AWS) regained momentum with a 19% increase in revenue, reaching $27.5 billion for the quarter. What a great business! Operating income from AWS hit $10.4 billion. The company is still investing heavily in infrastructure to capitalise on this, with a record $75 billion planned in capex spending for 2024, most of which will support cloud and AI services.

Amazon's e-commerce segment continues to show resilience, with a 7% growth in revenue to $61.4 billion. That's a lot of diapers and dogfood sold! The advertising arm had another great quarter with a 19% year-on-year increase to $14.3 billion, highlighting the effectiveness of Amazon's ad platform in reaching its vast customer base. Resellers pay big bucks to be featured prominently in the online store.

Amazon remains competitive across so many retail categories, notwithstanding competition from new players like Temu and Shein. They're launching budget-focused services inspired by these platforms and are expanding fast delivery to more rural areas.

Operating profit soared to $17.4 billion, significantly outpacing the $14.7 billion anticipated by analysts. These results led Amazon's stock to jump 7.3%, marking a 30.1% rise year-to-date. Its trading very close to its all-time high, which is just above 200 bucks a share.

We feel great about owning this one!