Google had quarterly results out on Tuesday night, and they were excellent. The stock price rose 2.8% on Wednesday, repairing some of the damage done since July by the US Government's annoying antitrust suit.

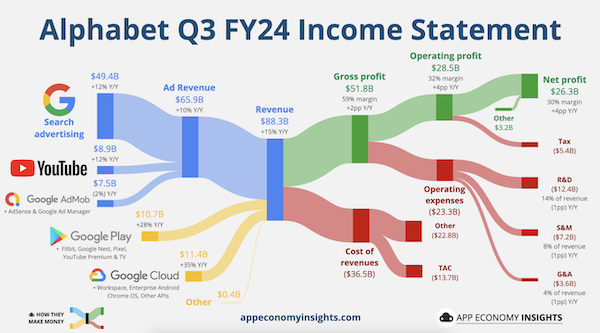

Revenue and profits beat Wall Street's estimates thanks to strength in the company's core search business and its cloud-computing operation. YouTube, subscriptions and devices also over-delivered. The whole company's operating margin is now 40.3%, the highest since 2019.

Google is currently fighting several antitrust challenges brought by the US Justice Department. The cases are nonsense and the officials pushing them are leftist zealots, in my opinion. The Feds are expected to file papers by 20 November that could seek a breakup of the company. Google's lawyers will fight these tooth and nail, and the process will drag on for years. The Feds might also lose interest, depending on who leads the next administration.

Google is displaying admirable restraint on costs, slowing hiring and office space development, while still investing heavily in datacentres for AI tools. Capital spending in the year ahead will be $51 billion.

CEO Sundar Pichai noted that over 25% of Google's code is now written by AI. That's quite something, given the scale of their operations.

Relative to its earnings, Google is cheaper than the other tech megacaps that we own in our portfolios. We recommend that you own a chunky amount of Google shares in your Vestact portfolio.