Last week Amazon released results that had many positives and a few negatives. Weak overall market sentiment has been more influential than earnings releases in recent days, so Amazon got pulled down with the rest.

In these quarterly numbers for the period to the end of June, overall retail sales slightly missed expectations, due to moderating international turnover, but US retail was solid. Importantly, sales at AWS came in better than expected.

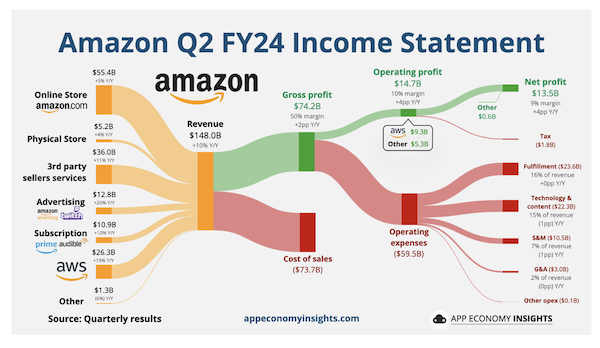

The image below says more than a 1000 words. Take a look at the divisional breakdown on the left which shows the growth rate for each segment of the business. AWS (19%) and advertising (20%) were the standout winners. It looks like AWS actually stole some market share back from Microsoft Azure this past quarter which is against the recent trend.

CEO Andy Jassy and team plan to keep on spending big on AI infrastructure. This is in line with the other big tech giants, as no one wants to be left behind. Like Meta, Amazon also offers an AI platform, "LLM as a service", which is expensive and requires huge data centres. Amazon has both the money and the existing infrastructure to be a really big player in this exciting new sector.

Amazon is a market leader in both online retail and cloud services. It ticks all our boxes and we are happy to carry on accumulating this stock, especially into the recent weakness.