Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Shares of Nike fell 20% on Friday after the company said it expects sales to decline in the year ahead. The athleisure market leader reported earnings per share of $1.01 for the quarter, compared to the 83 cents that analysts expected. But its revenue fell short and the management team was not sufficiently positive about the near-term future.

Nike's lifestyle (sneakers) business has struggled due to weak demand. There has been a delay in launching new running shoe models. Sales in China have been poor. As we've noted recently, there is more competition from traditional rivals and upstarts. Bloated stock inventories remains a problem.

Can Nike stage a comeback? CEO John Donahoe said 2025 would be a "transitional" year for the company during its earnings call. The company's founder Phil Knight was supportive in a statement released on Friday: "I have seen Nike's plans for the future and wholeheartedly believe in them."

Nike is a powerful company, with 83 700 employees, much-loved brands, and over $10 billion in cash on its balance sheet. The company is drifting, not in real trouble. It can afford to re-invest in product innovation and marketing at the major sporting events taking place in Europe this summer.

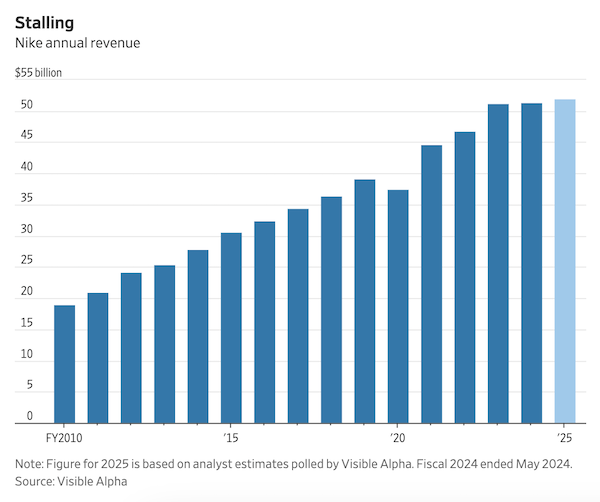

We want our portfolio companies to display dynamic top-line growth. Consider the chart below from the Wall Street Journal, which displays how well the company performed by that metric, from 2010 onwards. We started buying them for clients in 2011. The blips before and after Covid-19 is evident. The problem with the current period is also clear, and explains the market's negative reaction.

We can't throw out our holdings every time they go through a tough patch. Nike's turnaround could take a while though, and some of you may be keen to sell out. If so, let us know. I'm going to be holding on to my personal stake.