Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

I read a very detailed report by Business of Fashion on the rise of sportswear challenger brands, and here's my takeaway on the matter.

Nike and Adidas still dominate the sportswear market, but they're facing serious competition from newer brands like On, Hoka, Arc'teryx, and Salomon. These up-and-comers are quickly gaining ground, and the market is splitting into two camps: the established giants like Nike, Adidas, Puma, and Under Armour, and the challengers like Lululemon, On, and Hoka.

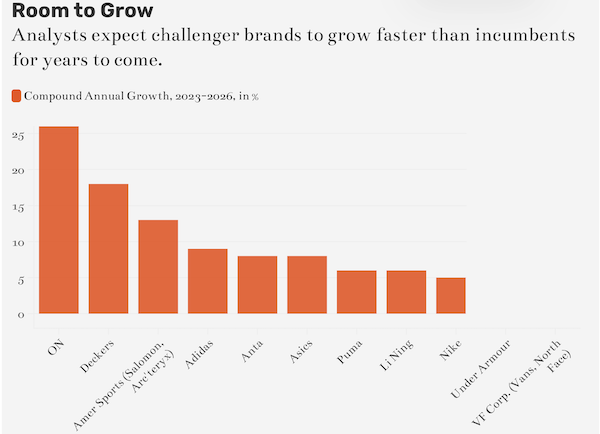

In 2020, major brands held 80% of the market. Now, their share is down to 65%. Challenger brands grew at an average annual rate of 29% from 2021 to 2023, off a small base, while incumbents only managed 8%. This trend is set to continue, with challengers projected to grow at 11% annually from 2023 to 2026, compared to 5% for the big names. As you can see, the sportswear market as a whole is growing nicely.

Despite some struggles, Nike and Adidas are still massive players, with Nike's revenue at $51 billion, more than double Adidas'. But the gap is closing. These challengers are expanding by opening their own stores and entering major retailers. Salomon, for example, is capitalising on the growth of its SportStyle brand, and just opened its first SportStyle store in Paris.

I'm bullish on these newer brands, but they may not all continue to thrive. For the record, Asics' stock is up over 128% from January, On's stock has risen 56% year-to-date, and Deckers (Hoka's parent company) is up 47% this year. In comparison, Nike's shares are down 10%, Puma is down 12%, and Under Armour is down 20%. Adidas is an exception, with its stock up 21% due to popular sneakers and a strong recovery after ending the Yeezy partnership.