On Thursday last week Alphabet (Google) released second quarter results. Revenues came in at $38.3bn, which was 2% lower than the second quarter of 2019 but 3% higher than expectations. Earnings per share smashed expectations by 28%, coming in at $10.13 a share.

As expected the advertising business took a knock. Businesses have less cash to spend on marketing and people click on fewer ads when they have less money to spend. Advertising still makes up nearly 80% of this business. Within the advertising business Youtube saw decent growth. Youtube now makes up nearly 13% of ad revenues.

What was very encouraging was the solid growth in Google cloud (sales up 42%) and Google Other, which includes Android and the app store. That was up 25% in sales.

In this environment Alphabet can be considered a value play. Unbelievable for a "FANG" stock I know. It trades on 20 times forward earnings and has over 120bn in cash. That is cheeper than the market average. They don't pay a dividend but are currently running a massive share buyback program. An extra $28bn was approved for buybacks this quarter.

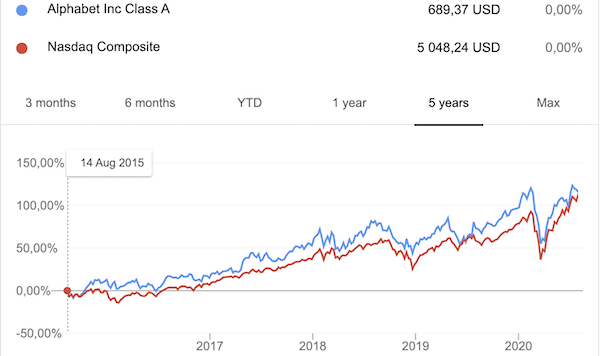

I compared the share price of Google to the Nasdaq index and the performance is very similar, see graph below. This means that Google shares have not done anything special for a while.

We see this as a really good buying opportunity. We have seen Apple and Amazon go through big patches of strong outperformance as their share prices rerate. Google is due a period of strong outperformance soon. Load up now.