Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

On Friday morning Richemont announced its unaudited consolidated results for the six month period ended 30 September 2017, showing what we mostly already knew thanks to numbers from their competitors. After having a tough couple of years, mostly due to the corruption crack down in China, they are back on the growth path. This was highlighted by a resurgent Hong Kong.

China is creating around four dollar millionaires every minute, meaning it was only a matter of time until the dent in luxury demand due to the corruption crackdown was replaced by natural demand. Interestingly the UK had double digit growth, I wonder if that is due to the weaker Pound resulting in comparatively cheaper prices for their products in London than in the rest of Europe.

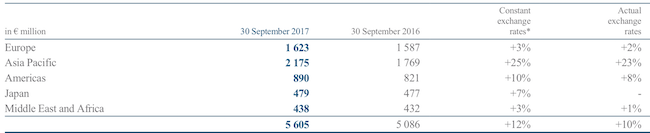

Here are the numbers, Sales were up 12%, Profit was up 80% and operating margins improved from 15.7% to 20.8%. Below are each regions sales numbers.

Management did point out that the impressive looking growth figures are in part thanks to a low base due to a number of once-offs in the last period. What is important though is that every region is showing growth and that both watches and Jewellery divisions are showing growth, 6% and 15% respectively.

The turnaround in luxury can be seen in the share price of Richemont, which is up 38% year to date, currently sitting around an all-time high. For comparison LVMH, is up 37% year to date (in Euros). Going forward, the rapid growth in global wealth is forecast to continue, which will provide a growing customer base for all the luxury brands. The trick is to stay relevant, and for Richemont owning brands that are over a century old provides a good moat.