You will recall that we introduced the MTN results yesterday, just to recap a little with the numbers that are most important, we wrote this in the message yesterday:

Revenue for the full year is up only 6.4 percent to 146 billion Rand, EBITDA margins increased by 150 basis points, EBITDA increased by 10.2 percent to 65.5 billion Rand. Astonishing. HEPS clocked 1536 cents, up 8.9 percent. The dividend was a record 1245 cents for the year, 800 cents in the second half. Subject of course to a 15 percent withholding tax, that is 680 cents. For the full year that amounts to 1058 cents per share. At a current share price of 211.74 Rand the company trades on 13.78 times price to earnings multiple with a post tax dividend yield of 5 percent. Or just shy, 4.99 percent. We will flesh these out over the coming days.

So the company looks cheap? Is that as a result of declining revenues in their home market South Africa? Or is it that the company is continuing to see pressures on their voice revenues, a price war has seen a race to the bottom. There have been casualties in this, word on the street is that Cell C are creaking, the ship is taking some serious water. A plan is underway to determine what can be done there, whether or not the business is for sale. Not in a good way.

Data is definitely growing like gangbusters. Here is the opening paragraph across all of their networks across all of their countries:

Data services remain the key driver of the Group's revenue growth and increased their contribution by 3,8 percentage points to 18,7% of total revenue in 2014. In the year, the number of data users increased by 22,8% to 101,2 million as we expanded our 3G and LTE networks and stimulated the adoption and usage of data-enabled devices and smartphones. At the end of December, we had 51,9 million 3G-enabled devices on our network, an increase of 30,4% on the previous year.

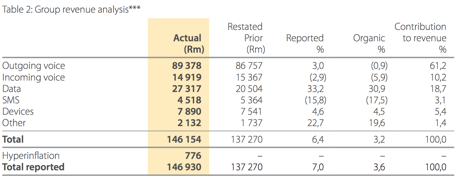

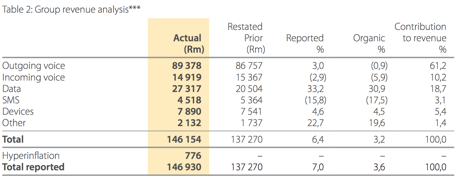

There are a few interesting things from this table of revenue contributors across the group. First of all, what is an SMS? Kidding, I SMS my wife a lot, WhatsApp does not always work if you do not have a reliable and steady connection. Plus sometimes you are stuck in groups that you may (or may not) want to be on. Here goes:

Voice is still a large part of revenue. If you were looking from the US you may scratch your head. Obviously lots has to do with the quality of the subscriber and the quality of the handsets that the subscribers have. MTN spend over 7.5 billion Rand a year on superior handsets, subsidising them so that their users and customers can pay more and more over time for a "better" phone. We not only want to be richer and better looking, we want a better handset for faster internet speeds.

The growth segments (if you look in the

AT&T 2013 Annual report) in the US are the same as here, data. Yet data represents an astonishing 83 percent of revenues, MTN have a long, long way to go before they are remotely close to maturing. More importantly, if you believe that growth in Sub Saharan Africa will improve at a much faster pace than before, this company is for you. We continue to recommend this company as a buy.