Market scorecard

US markets were little changed last night, with traders treading carefully ahead of a wave of delayed economic data when the government shutdown ends. The tech-heavy Nasdaq was dragged lower by a few big names like Amazon, Oracle, Meta, and Tesla.

In company news, AMD (Advanced Micro Devices) surged 9% after forecasting stronger five-year sales of its data centre chips. Elsewhere, Swiss sneaker brand On Holding AG surged 17.9% after delivering good results and saying it would offer no Xmas discounts. Finally, small nuclear power unit start-up Oklo climbed 6.7% on news that the US Energy Department approved its nuclear-fuel facility design, keeping it on track to deploy its first reactor.

In summary, the JSE All-share closed up 1.55%, the S&P 500 rose 0.06%, but the Nasdaq was 0.26% lower. That's ok.

Our 10c worth

Byron's beats

At the end of October our favoured Medtech company, Stryker, reported its third-quarter results. They were as solid as a double hip replacement. Sales came in at $6.1 billion, up 10% year-over-year, organic growth was higher by 9.5% (Stryker often does bolt-on acquisitions, so this is an important metric to look at) and earnings per share were up 11%. As I said, as solid as the titanium alloy they plug into people's bodies.

More than 75% of sales come from the US. I have been told that their sales and service teams are incredible in the US, but a little sloppy outside of the country. I have seen the Stryker building at the Buccleuch interchange north of Johannesburg; I wonder how much they do in sales in South Africa every year? Probably not a lot. We see expansion outside of the US as a good opportunity for the company.

Stryker is a very solid business that is operating in a growing sector and ticking along nicely, advancing at 10% per annum. It may not shoot the lights out, but it's important to have these stable companies in a diversified portfolio. We are still happy holders of this stock.

One thing, from Paul

I really liked this line from Shane Parrish, a Canadian writer who puts out the Farnham Street blog. He also wrote a book called "Clear Thinking" in 2023. That's him in the picture.

"Reliability is magnetic because humans are hardwired to avoid risk, so once you prove yourself trustworthy and reliable, you become the default choice for opportunities without ever asking for them."

This has been my experience at Vestact. We work hard at being responsive and reliable. We don't mess around, we focus on our clients. We keep them away from trouble.

As a result, we are constantly opening new accounts, even though we don't spend a cent on marketing.

Michael's musings

It happened, South Africa's inflation target is now officially 3%. Well done to the Finance Minister and the SARB Governor for having the courage to make the change, even though there has been pushback from certain quarters.

Why has there been pushback if this is a good idea? In order to have lower long-term interest rates, it requires us to have higher interest rates now. If you have monthly debt repayments due, you want lower rates now. I recently bought a house, and the first 5 years of a home loan are when you pay the most interest, so it would be nice for me if rates were lower.

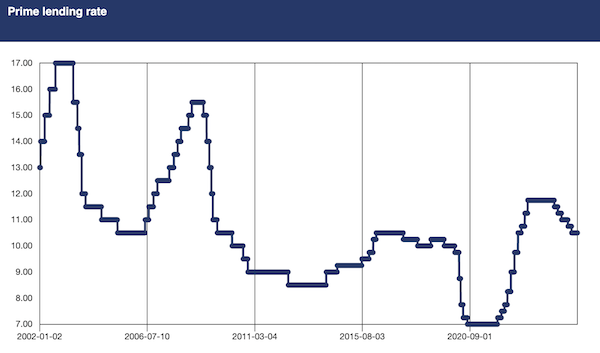

The prime rate is currently at 10.5%, a year ago it was 11.75%, so interest rates have already been falling, just maybe not as fast as some people would like. Also, 10.5% on a historical basis, isn't that bad. In the years leading up to Covid, interest rates were between 9.5% and 10.5%. Go back to 2008, it was 15.5%, and in 2003 it was 17%. Ouch!

As the market and economy adjust their expectations to this "new normal", we should see significantly lower interest rates. For property owners, lower long-term rates will really boost property prices, my house included.

Bright's banter

Whoop is an American wearable technology company headquartered in Boston, Massachusetts. Will Ahmed started the company back in 2012 and his niche idea for elite athletes has ballooned into a global wellness business operating in 60 markets, with subscriptions up 20x since 2020 and 75% in the past two years.

Now, Ahmed says Whoop is "well-positioned" for an IPO in the next two years, supported by proprietary hardware, software, analytics, and even apparel. The latest model, the medical-grade Whoop MG, adds blood-pressure tracking, ECG capabilities, AFib detection, and biological-age scoring. Bloodwork integration is now live, and hormone and metabolic panels are expected to arrive in early 2026.

Competition is heating up with Oura (my personal favourite), Samsung's new smart ring, and several big-tech glucose-monitoring moonshots all circling the same "personal health" category. Whoop's business model is different - no device fee, only a membership subscription (up to $359/year), making the hardware effectively useless if you cancel.

Whoop aims to become a "health operating system," eventually utilising its AI models to predict heart attacks, strokes, and other major conditions. If it pulls that off, this could be one of the most interesting IPOs in consumer health in years.

Linkfest, lap it up

Apple's Siri hasn't kept up with AI advancements. The easiest solution is to team up - Apple to pay Google $1 billion a year for Gemini.

Alzheimer's is a terrible disease. There's a new pill called valiltramiprosate - Some hope for people with high genetic risk of Alzheimer's.

Signing off

Asian markets are mixed this morning. In Taiwan, Hon Hai Precision (also known as Foxconn) struck an upbeat tone on the year ahead, saying AI development is set to be its biggest growth engine. That stock has been on a good run lately.

In local company news, Bidcorp delivered resilient results for the four months to end-October, with trading profit up 8.6% and revenue up 8%. This was thanks to steady demand across Europe, and solid performances in SA and the UK.

US equity futures are moving higher in early trade. The Rand is at R17.07 to the US Dollar, can it break into the 16s?

Take it easy.