Market scorecard

Wall Street wrapped up a shaky week on a high note thanks to some backtracking on China by President Trump and a rebound in regional banks. The S&P 500 ended up 0.19% higher for the week, which is better than nothing.

In company news, Oracle shares slipped 6.9% as investors continue to question how it will finance a massive push into AI infrastructure. Elsewhere, American Express topped earnings forecasts this quarter and reported a surge in sign-ups for its flagship Platinum card. Lastly, Shares of Novo Nordisk (-3%) and Eli Lilly (-2%) slid after King Donald said the "fat shot" (he was referring to Ozempic) should sell for $150 after discounts. He's just another politician currying favour with drug customers, instead of praising the brave capitalists who develop these valuable products. What a shame.

On Friday, the JSE All-share closed down 2.02%, but the S&P 500 rose 0.53%, and the Nasdaq was 0.52% higher. A pleasing finish.

Our 10c worth

One thing, from Paul

Given all the company news, drama and political noise, sell-offs, rebounds and very short recessions, most financial professionals just opt for passive investments, tied to the major indices. Why bother with trying to identify world-beating stocks? Just buy the market.

This approach is very appealing to the massive investment companies that exist to gather assets under management. They hawk products that sound innovative, but they are all just closet index-huggers. They'd rather not fall behind the overall market, so they run funds with hundreds of stocks in them.

Here at Vestact, we are trying to do better than that, by identifying major economic themes, picking emerging economic sectors, and avoiding yesterday's heroes. As Bright pointed out last week, we run portfolios with just 10 to 14 stocks, hoping that the concentrated holdings will deliver index-beating returns.

Viktor Shvets, head of global desk strategy at Macquarie Capital, seems to have a similar approach, recommending "portfolios built around sectors that are supported by long-term structural forces, rather than investing based on a heavily degraded reading of economic and capital market cycles."

He identifies a few promising themes, such as the replacement and augmentation of humans, and the need for balm, both metaphysical and real ("opium of the people"). So, basically, Nvidia and Netflix.

Byron's beats

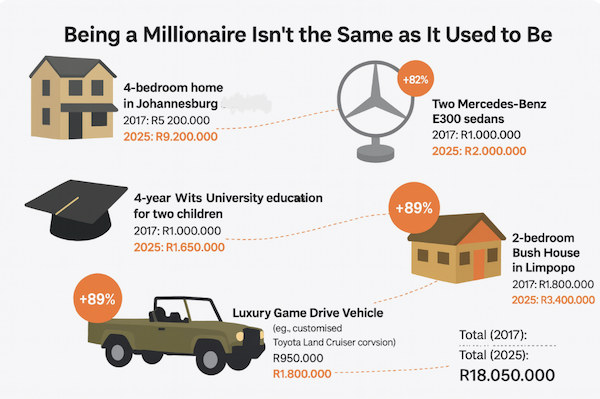

I saw an infographic the other day titled "Being a millionaire isn't the same as it used to be". It was targeted at New Yorkers and compares the prices of things rich people would normally buy in 2017 to what those things cost today.

A 4-bedroom home in the NY suburbs has gone from $758k to $1.1 million. Two Mercedes sedans has gone from $111k to $132k. A 4-year Harvard degree for 2 children has gone from $376k to $493k. A 2-bedroom upstate cottage has gone from $166k to $341k, and a 19 foot Sea Ray speedboat has gone from $35k to $59k.

The total for these items in 2017 was $1 448 177 and that rose to $2 123 460 in 2025.

I decided to plug the picture into ChatGPT and asked it to give me a South African version. Here is what it spat out. The increase from R10 million to R18million is significant, but it does show that you need half the amount of money to live the life of the rich and famous in South Africa compared to New York.

Bright's banter

In South Africa's townships, up to 79% of small businesses operate off the digital map, unseen by Google, untapped by banks, and unreachable by big distributors. That's the gap Matimba Nkuna's Timbuk2 is trying to close, one smartphone photo at a time.

Timbuk2 has built a Pokemon Go-like app for economic empowerment, paying local youth to map informal businesses in their neighborhoods. Each "data agent" earns cash for logging spaza shops, salons, or car washes into a slick, gamified dashboard. The result? A living, breathing map of the township economy that's been invisible for decades.

When Timbuk2 mapped Tlhabane in Rustenburg, they uncovered hundreds of undocumented businesses and even discovered new water purification sites. For brands, banks, and policymakers, that data is gold.

By 2026, Timbuk2 wants to scale across Africa, proof that when you hand people the tools to map their world, you don't just create data. You create dignity, access, and opportunity.

Linkfest, lap it up

Animals can teach us a lot about aging. From immortal hydras to everyday mutts - This life could extend yours.

Million-year-old skull rewrites human history. Homo sapiens emerged at least half a million years ago, earlier than we thought - We also co-existed with other sister species.

Signing off

Asian markets kicked off the week on a positive note, with Japan leading gains and most regional bourses trading higher. Malaysia and Singapore are closed for the Diwali holiday.

Shares in Melbourne-based auto spares reseller Bapcor tumbled nearly 17% after it slashed its profit outlook and revealed a A$12 million pre-tax earnings hit tied to "unsatisfactory operational practices" in its trade division.

In local company news, Premier is buying Rhodes Food Group in a R5.8 billion all-share deal that will create a R30 billion revenue powerhouse, putting it within reach of Tiger Brands and reshaping the local FMCG landscape.

US equity futures are slightly in the green pre-market. The Rand is trading at around R17.33 to the US Dollar.

The highlight of the week ahead will be Netflix's earnings out on Tuesday, after the closing bell.

Have a good one!