Market scorecard

US markets rose again yesterday after the final inflation print before next week's Fed meeting cemented expectations of a rate cut. All the major indices climbed, finishing at fresh record highs. CPI data showed US consumer prices rising 2.9% year-on-year in August, a slight acceleration from July's 2.7%, but exactly in line with economists' forecasts.

In company news, Adobe gained 2.6% after-hours due to a strong revenue outlook, signalling that its big AI bet is starting to pay off. Elsewhere, the US Federal Trade Commission turned its attention to AI's impact on kids, ordering Google, Meta, OpenAI, and others to hand over details on how their tech affects young users. Lastly, Opendoor Technologies rocketed nearly 80% as investors cheered the return of its co-founders to the board, alongside a fresh CEO appointment.

Izolo, the JSE All-share closed up 0.33%, the S&P 500 rose 0.85%, and the Nasdaq was 0.72% higher. Sweet moves!

Our 10c worth

Bright's banter

SA-listed financial services group Discovery has come a long way from its roots as a medical aid administrator. It now has an impressively diversified business, both in operating units and geography.

For the year to June, Discovery's headline earnings jumped 30% to R9.6 billion. Operating profit climbed 29% to R15.2 billion, but the most exciting part was the dividend growth of 32%. Shareholders are being rewarded for their patience.

Discovery Bank stole the show, booking its first profit in the second half, ahead of schedule, on the back of 30% client growth and strong gains in loans and deposits. Vitality, the global unit, surged 70% with standout growth in the UK.

Discovery Insure's profits more than tripled, thanks to competitive pricing and a lack of hailstorms, while Discovery Invest grew 29% on rising assets under management. Discovery Life and Health delivered steadier gains, while Ping An Health in China rose 22% on a large base.

Shares popped over 6% a week ago when the trading statement confirmed that the bank had finally turned profitable after years of cash burn. But after seeing the full picture yesterday, the market was less impressed and the shares closed down 9.6%. Maybe traders were disappointed that the traditional Discovery Life and Health units didn't shoot the lights out the way the smaller divisions did? We thought the numbers were great and will continue to hold this stock in local portfolios.

One thing, from Paul

Exceptional ability is rare. It's even more unusual to find individuals who are very talented in more than one area.

Gilles Gignac, a professor at the University of Western Australia, works on intelligence, financial literacy, behavioural economics, and narcissism. In a recent study, he looked for persons with exceptionally high IQ, conscientiousness, and emotional stability all at the same time. He found the ratio to be just 85 persons in every million.

There are about 60 million people in South Africa. This means that there might only be 5 100 standouts in this country. That's not a lot of us (I'm including myself in the select group because I'm naturally humble, LOL).

We should keep this in mind when recruiting CEOs, heads of organisations and political leaders. The pool of people who are very smart, hard-working and have good inter-personal skills is not that deep.

I suppose that as the singer Meat Loaf notes in that hit album from 1977, "two outta three ain't bad".

Byron's beats

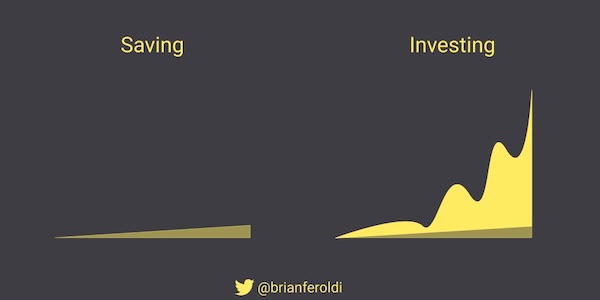

Markets are at all time highs, and it feels good to be long stocks. It's not always this easy. There will be another period of volatility in the near term. When or why that will happen is impossible to tell, and that is why we don't try to time markets.

Market uncertainty is the flipside of higher returns. That niggling anxiety that the market could fall at any time and the nasty selloffs are part of the deal when investing in listed equities. A guaranteed return from a cash deposit with little to no capital risk will produce a lesser outcome. You only get paid for absorbing risk. That is how life works: no pain, no gain.

A portfolio of quality shares is risky in the short term but low risk in the long run. Cash is low risk in the short term but is guaranteed to go backwards against inflation in the long run. I have shared this picture before but it's worth repeating to drum home the message.

Michael's musings

On Wednesday, Oracle's share price rocketed 36% higher on solid growth in its cloud division. This meant that founder Larry Ellison was briefly the richest person in the world at an estimated net worth of $383 billion. Elon Musk has $384 billion, and Mark Zuckerberg is third with "only" $264 billion.

The jump in Oracle's share price added around $100 billion to Ellison's wealth overnight, which got me wondering how much of the company he still owns. He still has an impressive 40% stake, much higher than the founders of similar companies.

Mark Zuckerberg owns around 13% of Meta, Larry Page and Sergey Brin own a combined 6% of Google, Jeff Bezos only owns about 9% of Amazon, and the late Steve Jobs sold all his Apple shares twice. Interestingly, Bill Gates held 49% of Microsoft when it IPOed in 1986, but as he has sold down to give money to charity and diversify his holdings, he only owns about 1% now. If he had kept 28% of the company, he would have been the world's fist trillionaire.

Well done to Larry Ellison.

Linkfest, lap it up

High-end travel advisor is a hot new profession. Curating bespoke tours is a complex task - Hotshots are quitting the finance sector to become travel agents.

Millennials love Lego and Star Wars. Would you pay R18 000 for a Death Star? - The most expensive Lego set ever.

Signing off

Asian markets are trading mostly higher this morning. Shares in BSP Financial (Bank South Pacific), the largest bank in Papua New Guinea, jumped over 8.5% after the country's prime minister reassured the lender it would continue to service and maintain government accounts.

In local company news, FirstRand has delivered a solid set of full-year numbers, with headline earnings up 19.5% to R41.88 billion. The standout came from RMB, while the UK and the rest of Africa operations saw softer growth.

US equity futures are marginally in the green pre-market. The Rand is trading at around R17.36 to the greenback.

Let's hope we have a solid end to the week.

Second time lucky for the Boks. Gooi!