Market scorecard

US markets had a strong start yesterday, although gains faded into the close. Both the S&P 500 and the Nasdaq still notched fresh record finishes. Some large caps rose smartly (like Nvidia +3.8%) and others had a rough day (like Amazon -3.3%).

In company news, from next year, Uber riders will be able to book Blade's helicopters and seaplanes straight from the app, expanding its tie-up with Joby Aviation. Elsewhere, Novo Nordisk is trimming 11% of its workforce as it tries to streamline and close the gap with Eli Lilly in the obesity drug market.

At the closing bell, the JSE All-share closed up 0.35%, the S&P 500 rose 0.30%, and the Nasdaq was just 0.03% higher. On we go.

Our 10c worth

One thing, from Paul

Every now and then a Vestact client asks us if we can get them into a hot new IPO, before it hits the market. The answer is always a flat "no".

We only buy stocks for people once they are trading on the regular market, in normal New York hours, for USD cash that is already in their accounts. No pre-market bidding or special favours. No monkey business.

Consider the recent listing of Figma. According to Wikipedia, it's "a collaborative web application for interface design. It focuses on user interface and user experience design, with an emphasis on real-time collaboration, utilizing a variety of vector graphics editor and prototyping tools."

Yeah, ok, I guess. Figma made its market debut by listing on the New York Stock Exchange (NYSE) under the ticker symbol "FIG" on 31 July this year. It priced its shares at $33, and surged on its first day of trading, closing at $115.50.

Sadly, it's down a lot since then, and last traded at $52.40. Their first quarterly earnings report was a trainwreck: margins got smoked, guidance was weak, and they announced plans for large acquisitions. For extra flavour, they revealed a Bitcoin holding on their balance sheet.

But wait, there's more. The insider lockup period expires at the end of the year, which means even more selling pressure could hit the stock.

This is the danger of IPO mania. Retail investors get excited and pile in early, but when fundamentals disappoint, they're left holding the bag.

Byron's beats

A long-standing client recently reached out because he was trying to work out his past returns. He first sent money to his US portfolio in 2008. Over the years, he has followed most of our advice and the portfolio has grown substantially. Credit to him, it's not always been plain sailing.

He's also been able to transfer shares from his portfolio to his kids, which I think is a much better outcome than your children getting all their inheritance when you are 6 feet under. These withdrawals have resulted in him taking out more money than he ever put in.

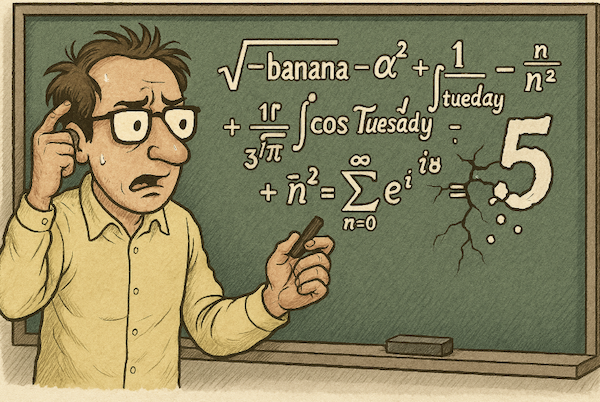

I plugged all the numbers into Microsoft Copilot and asked it to work out the Internal Rate of Return. The answer I got was amusing.

"It looks like the IRR calculation ran into a numerical overflow error - likely because the final value is extremely large compared to the net cash flows, which causes instability in the formula".

The performance figures broke both maths and AI. That is what we like to see, LOL.

Michael's musings

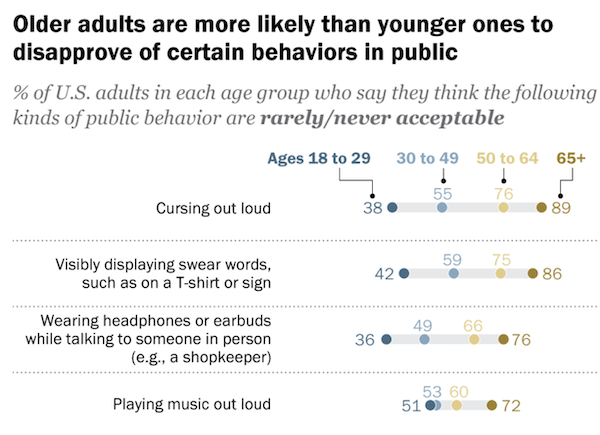

It really annoys me when someone sits in public having a conversation with their phone on speaker mode. The talking is noisy from both sides, and I really don't need to know your business. Maybe I'm just getting old.

Pew Research recently asked US adults what behaviour they found rude in public. Unsurprisingly, for certain things there was a big deviation by generation. Swearing for example, saw a very large divergence. Younger people were not as bothered by rough language.

Taking a picture of someone without their permission was regarded as unacceptable, by people of all age groups.

One that surprised me was smoking. My assumption would have been that younger generations would be more sensitive to secondary exposure because older generations grew up with smokers everywhere, including on aeroplanes. No one likes smoking, but older people were still more sensitive to it.

Society is constantly changing and we ought to stay up to date with social norms, and try to keep an open mind, but maintain standards. Here are the full results - What counts as rude.

Bright's banter

Nasdaq has filed with the SEC to let investors trade tokenised versions of stocks on its exchange, effectively testing whether blockchain can be embedded into the core of Wall Street's market infrastructure.

If approved, tokenised shares would be treated like traditional stocks with the same rights and same execution priorities, they will just be running on blockchain rails. Proponents say this could allow for fractional ownership, faster settlement, and even round-the-clock trading.

Nasdaq's move is part of a broader trend of big finance edging into crypto, from BlackRock to JPMorgan, as regulators in Washington open the door wider to digital assets.

Tokenisation, once a fringe crypto dream, is now being explored by the same institutions it was supposed to disrupt.

I always thought crypto was meant to bypass traditional finance. It's ironic that traditional finance might now bring it to a wider audience.

Linkfest, lap it up

Some jobs are interesting. Others are plain brutal with low salaries - What it's like to be a Hollywood production assistant.

The EU lags the US on technology. A restrictive regulatory environment has made development difficult - Uber and Momenta will finally start testing driverless cars in Germany.

Signing off

Asian markets are mixed this morning. China and Hong Kong are sliding after Mexico slapped tariffs of up to 50% on over 1 400 Asian imports to shield local producers from US trade heat. Meanwhile, Aussie inflation expectations jumped to 4.7% in September, up from 3.9% in August. That's frothy.

In local company news, Remgro says full-year earnings will jump by up to 43%, thanks to stronger showings from Rainbow Chicken, RCL Foods, Outsurance, and Mediclinic.

US equity futures are pointing towards a positive open. The Rand is trading at around R17.49 to the US Dollar.

Let's get it on.