Market scorecard

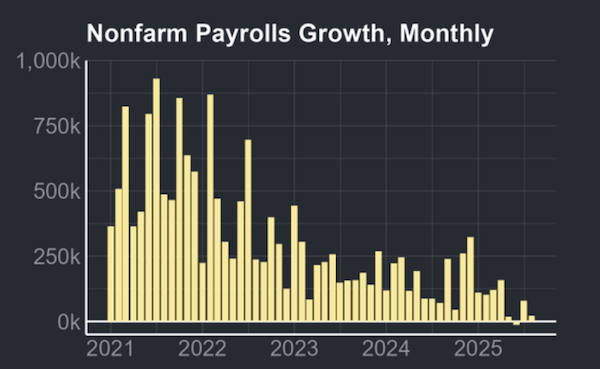

US markets closed down on Friday after benchmarks initially hit fresh intraday highs. Traders are now betting on three rate cuts this year, due to very weak jobs data that was published before the opening bell, but revisions to prior month numbers have raised fears that a more significant economic slowdown is on the way.

In company news, Broadcom jumped 9.4% after announcing a partnership with OpenAI to develop AI accelerators. Elsewhere, financial stocks tumbled on the prospect of interest rate cuts, with Charles Schwab down 5.7% and Wells Fargo down 3.5%. Finally, Apple's annual sales in India hit a record $9 billion, underscoring the iPhone maker's growing footprint in the world's biggest consumer market.

On Friday, the JSE All-share closed up 1.09%, but the S&P 500 fell 0.32%, and the Nasdaq was 0.03% lower. Hmm.

Our 10c worth

One thing, from Paul

The US economy is slowing, and job growth has ground to a halt. Consumer and business confidence are low. Immigration has slowed to a trickle, so the US population will probably decline this year, for the first time in history. Inflation is above the desired level of 2% per annum because of tariffs. Small businesses that import manufactured goods from outside of the US are panicking.

But isn't the stock market at all-time highs? Yes, it is. I ask you this, how much higher would the market be with none of the policy own-goals described above?

Instead of feeling anxious about these economic trends, Donald Trump seems quite pleased with himself. He's clearly enjoying his second term very much, pushing the limits of his Presidential power.

I read somewhere that: "Conservatism exists to resist radical schemes built on abstractions. It favours experience, tradition, and practical knowledge over theories spun in the clouds." That's fine, but it's not great if pro-business, small-government conservatism is turned on its head by ideologues who delight in fighting culture wars and bullying international allies. Meddling with global trade flows is counterproductive.

It remains to be seen what happens next. Will the Fed cut rates aggressively, or will they be restrained by the messy inflation outlook?

To be fair, Trump's tax bill resulted in corporate tax cuts that are positive for company earnings, and as we know, in the long run, earnings are the most important driver of stock prices.

As always, we will not overreact to the politics of the day, and will stay fully invested in our well-balanced portfolios. Large companies are very resilient.

Byron's beats

I've been investing in listed equities for myself and clients for over 16 years now. When I look back at the journey, I have concluded that the most important attribute for a successful investor is temperament. This is especially true in this day and age, where most information is free and AI chatbots can answer all your in-depth questions.

The maths and modelling is the easy part. AI subscriptions and reports from smart analysts can be bought online for a few Dollars. Temperament, however, does not have a price. For some, it comes naturally, for others it takes years to refine.

For me personally, it was a bit of both, but it took time and I am still learning. It certainly helped to have an experienced colleague who is completely unshakeable. Thanks, Paul! The entire Vestact team is calm and collected and it's great to be able to lean on them when times get rough.

Vestact's ability to remain even-handed and steady on behalf of our investors is one of the most important parts of our service.

Michael's musings

Tesla has just proposed a new pay package for CEO Elon Musk, which makes the current $56 billion disputed deal look like pocket change. Tesla is asking shareholders to award Musk 12% of the company if he is able to increase the current market cap by 8 fold. If you are quick at maths, you will have worked out that the 12% would be worth $1 trillion if Tesla has a market cap of $8.5 trillion.

I expect shareholders to approve the package. Musk has a loyal following, and awarding him 12% of the company in exchange for an 800% increase in the value of my own Tesla holding seems like a fair exchange. $1 trillion might sound like a very large number, and it is, but when compared to the value created, it isn't bad. For example, a hedge fund that charges 20% on the gains would be charging $1.4 trillion for the same growth.

Musk has been given some serious growth targets. As he hits each milestone, a percentage of shares will be paid out. The targets include increasing the profitability, putting a million robotaxis into service and reaching a three-month average of 10 million subscribers for Tesla's Full Self Driving service.

Finally, the primary goal is to reach a market capitalisation of $8.5 trillion, which Tesla notes is double the value of the largest company currently in existence. That's a very big number! If anyone can do it, Musk is the man. Only time will tell if it's a realistic outcome.

Bright's banter

OpenAI is expanding beyond chatbots and into careers. The company plans to launch its own "Jobs Platform" in mid-2026, promising AI-driven matching between employers and candidates, plus a certification programme that could train 10 million Americans by 2030.

Walmart is already on board as a potential client. This is a bold play, especially since LinkedIn is owned by Microsoft, OpenAI's earliest and most important backer.

The timing is interesting to say the least, as reports just surfaced that OpenAI is also building in-house AI chips with Broadcom, despite its ongoing chip partnership with Microsoft.

Linkfest, lap it up

Just do it!. That's been Nike's slogan since 1988 - Gen Z might prefer the adjustment to 'Why do it?'

GLP-1s have been added to the Essential Medicines list. The WHO believes these drugs should be available in all functioning health systems - This is a boost for Eli Lilly.

Signing off

Asian markets are mostly in the green this morning. Japan led gains after Prime Minister Shigeru Ishiba announced he'll step down. Benchmarks in New Zealand, Hong Kong, South Korea, Malaysia, Indonesia, and Taiwan also traded higher.

In local company news, African Rainbow Minerals slipped 3.8% after warning that full-year earnings could fall by as much as 47%. The hit comes from weaker iron ore prices and rising costs, particularly at its Bokoni platinum mine, where losses came in at R1.4 billion.

US equity futures are modestly in the green pre-market. The Rand is trading at around R17.58 to the US Dollar.

Have a good week.