Market scorecard

US markets finished higher yesterday, with big tech stocks doing the heavy lifting. Thanks to that favourable court outcome, Google jumped 9% and Apple climbed 3.8%. Not everything sparkled though: oil prices slipped on chatter that OPEC and allies may raise output again, sending energy shares down 2.3% to the bottom of the S&P 500's sector rankings.

In company news, ServiceNow is dangling discounts of up to 70% for federal agencies in the hope of speeding up AI adoption across government departments. Elsewhere, Pfizer felt the need to step in and defend its Covid-19 vaccine research after President Trump suggested on social media that drugmakers might be "sitting on information". Finally, NuScale Power jumped 8.5% on news of a deal to develop several modular nuclear reactors for the Tennessee Valley Authority.

At the close, the JSE All-share was up 0.34%, the S&P 500 rose 0.51%, and the Nasdaq was a full 1.02% higher. Nice one!

Our 10c worth

One thing, from Paul

Paul Zummo (pictured here) is a bigwig at JP Morgan Asset Management and he summarized his last 30 years of managing money on Wall Street in point form. I found these ones interesting.

Just say no. You're more likely to regret making a failed, poorly-conceived investment than missing a good one.

It's only a great investment if you can hold it. Stress test how the investment might hold up under material market pressure.

The opposite of a long isn't a short. Some investors are good at finding the one, not the other.

Don't make logical decisions based on flawed information. Take the time to ensure quality inputs and appreciate the flood of biased information during market extremes.

Avoid casinos. Black isn't "on a roll" and red isn't "due."

Dinosaurs go extinct. Innovation must be a constant.

Understand (and maintain) your competitive edge. If you can't measure the bar, you'll never really know if you're above it.

Byron's beats

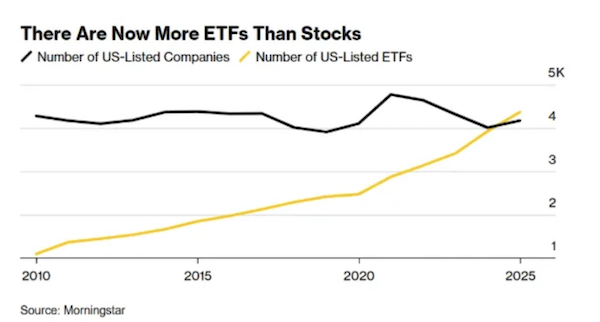

One of the biggest benefits of a broad exchange-traded fund (ETF) is that it allows you to own the whole market at very low fees. Many advisors feel that owning a long-term portfolio of 2 or 3 ETFs is all that is required to grow your wealth. That's hard to argue with.

The problem, however, is that there are now more ETFs than US-listed shares, according to Morningstar. There are sectoral, theme-based and leveraged ETFs too.

Unless you are a sophisticated investor, you will need to pay an advisor high fees to pick you a portfolio of ETFs, many of which also attract high fees. Jack Bogle, the godfather of ETFs, must be rolling in his grave. He invented the product because it was simple and cheap. Wall Street has flipped that philosophy on its head. Classic.

Anyway, this suits us just fine. The more complicated and expensive competitive products are, the more business we get.

Michael's musings

Targeting millennial nostalgia has always been a reliable sales tactic. Millennials are now the largest generational group in the working world, and have 'adult money' to spend.

On Tuesday, Activision (owned by Microsoft) and Paramount announced a deal to bring the popular game Call of Duty (COD) to the big screen. COD has been the best-selling video game series in the US for 16 consecutive years, with more than 500 million copies sold globally.

I haven't played COD for over a decade, but I have very fond memories of playing COD 2 as a teenager. There are now over 30 versions of the game, so it's displayed impressive longevity. I'll be lining up to watch this movie when it hits the screens.

Bright's banter

Nation states are focusing on AI as part of their national security strategies. They are pouring billions into Anthropic, OpenAI, or xAI, which isn't just making a bet on algorithms or enterprise software, it's also underwriting Nvidia's future.

All these AI labs, with their ballooning valuations and insatiable appetite for computing power, ultimately compete on one thing: access to high-end chips. Whether it's Qatar's $13 billion backing of Anthropic, Abu Dhabi's splash into OpenAI, or Saudi stakes in xAI, the capital is flowing into firms that can't function without Nvidia's GPUs.

That creates a flywheel effect, more AI funding to create better models means more competition between companies to stay relevant, leading to more demand for chips. While sovereign funds talk about building "national champions", the true champion remains Nvidia, quietly selling the shovels in this AI gold rush.

If the Middle East wants to write trillion-dollar cheques into AI, Jensen Huang is the man cashing them. Investors should remember, the AI boom is many things, but first and foremost, it's a chip story.

Hold on to your Nvidia shares!

Linkfest, lap it up

How does Netflix create new shows? They use the data that you help to generate - They feed you more of what you seem to like eating.

Online gambling is growing quickly globally. Indian authorities are moving to ban it - Players will probably just move to unregulated sites.

Signing off

Asian markets are mostly in the green this morning, other than in China where stocks are down. But they are hot in Japan, lol.

In local company news, Woolworths rose 2.3% as it posted full-year sales which were up 6.1% to R81 billion. Weakness at Country Road, where sales fell 5.4%, dragged earnings lower. Woolies food remains unbeatable. Elsewhere, Discovery jumped 4.5% after flagging a possible 32% rise in headline earnings for the year to June. Discovery Bank swung into profit in the second half.

US equity futures are marginally in the green pre-market. The Rand is trading at around R17.71 to the greenback.

Have a top day. It's Friday tomorrow.