Market scorecard

Yesterday was a quiet one on global markets, as the US was out of action for the Labor Day holiday. Equity futures are edging higher this morning, as traders trickle back to work after their summer break.

In company news, OpenAI is looking to plant a big flag in Asia, with plans for a massive new data centre in India. In Italy, Banca Monte dei Paschi is pressing on with its takeover push for Mediobanca, launching a EUR15.5 billion all-share bid that aims to secure a controlling 51% stake. Finally, Nestle has fired its CEO over an affair with a senior colleague. Chocolates weren't the only temptation in the office it seems; what a crazy way to end a corporate career. The head of its Nespresso unit will take over.

After a dull day, the JSE All-share closed up 0.06%. That's it.

Our 10c worth

One thing, from Paul

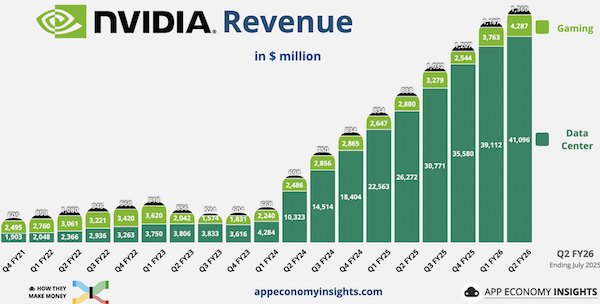

Visual images are a powerful way to make a point. Just look at Nvidia's data centre revenue lift-off, in the quarterly chart below. The huge growth came a mere two years ago, and has transformed the business.

Also, we already know that revenue in the next quarter will be (literally) off the charts. The guys at App Economy Insights will have to re-scale their vertical y-axis.

Byron's beats

Market pundits love to talk about current valuations of the US market, comparing the levels to historic averages. Currently, some of those levels are above average which they argue makes the market expensive. But is it really? If we are in the game of comparing levels to historic averages then we need to look at the whole picture.

For example, as of the second quarter of 2025, operating margins of the S&P 500 are sitting at 12.5%. That is 37% higher than the 25-year average of 9.1%. Companies with higher operating margins attract higher valuations. In other words, you pay up for quality.

Does it explain why US stocks are attracting higher valuations these days? Not entirely, but it is an important part of the puzzle. It is a reminder that you should never look at one statistic in isolation. Always try and see the whole picture.

Michael's musings

The Dollar/Rand exchange rate is currently very favourable, but only a few clients have been adding to their portfolios. Why is that? Typically, as the Rand strengthens, many cash deposits roll in, but not this time. It's probably because markets are at all-time highs. Some clients have told us that they are waiting for "a pullback", whatever that may be.

However, there are many reasons to think that markets will continue to climb from here. History shows us that periods of all-time highs are a very positive sign for further significant gains.

There are three main reasons why, over the long term, stocks will continue to go higher. First, global populations are growing, so more customers means more profits and higher share prices for the global companies that we own. Second, global populations are getting richer, especially in the developing world where people are moving out of poverty and into the middle class.

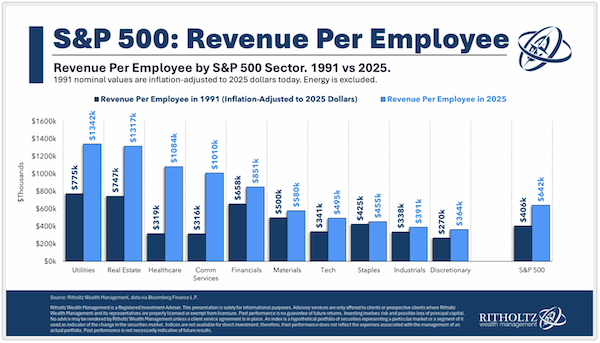

Third, companies are continually becoming more efficient as they embrace new technologies. This allows them to grow profits without needing to increase revenue. Take a look at the graph below, which shows how companies have been able to achieve 50% more productivity per employee. It directly relates to Byron's observation about operating profits above. We are living through the AI revolution which will lead to further profit margin gains, which will be spectacular for share prices.

A fourth, bonus reason why stocks will go higher is inflation. All things being equal, share prices go up over time to take inflation into account.

Keep investing, and keep it simple. Add regularly, and don't try to time the market.

Bright's banter

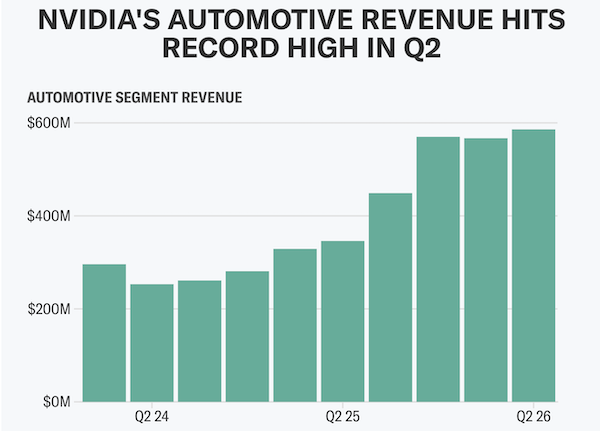

Nvidia's data centre sales overshadow everything else the company does, but quietly in the background, its vehicle arm is starting to become a serious business in its own right.

In the latest quarter, Nvidia's automotive revenue reached $586 million, a 69% increase year-on-year, driven largely by demand for its self-driving solutions. The big milestone was the launch of Drive AGX Thor, the successor to its Orin platform, which combines Nvidia's chips with its DriveOS software to form a "full stack" for advanced driver-assistance systems.

Toyota is among those adopting Nvidia's awesome tech, joining Mercedes-Benz, Volvo, BYD, and Foxconn. CEO Jensen Huang has previously guided that the auto division should pull in $5 billion this financial year, with an eventual path to becoming a trillion-dollar business. That may sound ambitious, but Nvidia's reach into the future of transport keeps expanding.

Tesla uses Nvidia GPUs in its supercomputers and, with the EV maker shelving its Dojo project, it will lean even more heavily on Nvidia chips to train autonomous driving models. Waymo, Alphabet's robotaxi unit, also taps Nvidia hardware for its fleet.

The convergence of robotics and supercomputing is what Huang calls "physical AI" - cars, robots, and machines using AI to interact with the real world. He sees this as the first multi-trillion-dollar opportunity for robotics, with Tesla's Optimus robot and robotaxi ambitions fitting squarely into that vision.

There are many reasons to like Nvidia. Beyond its grip on AI data centres, it is becoming central to the automation of industries from cars to robotics. That breadth makes the company not just a one-trick chipmaker pony, but a critical enabler of the next industrial revolution.

Linkfest, lap it up

AI is helping doctors spot cancer. Once used, they become dependent on the technology - Health-care systems are embracing AI to boost patient outcomes and productivity.

John Cena is a legendary wrestler-turned-actor. The second season of "Peacemaker" is getting positive reviews - This guy can really act.

Signing off

Asian markets were a mixed bag this morning. Hong Kong, mainland China, and Taiwan slipped, while India, Indonesia, Japan, New Zealand, South Korea, and Singapore all managed to trade higher.

In local company news, Bidvest slipped 5.9% after reporting a 3% drop in annual earnings, hit by weaker performance in its freight and commercial products divisions. Still, revenue for the year to June rose 5% to R126.6 billion, with trading profit edging 1% higher at R12 billion.

The Rand is at R17.64 to the US Dollar.

We still have a few laggards to get results out this earnings season. We'll be keeping an eye out for Zscaler, Salesforce, Figma, Broadcom and Lululemon in the days ahead.

Ok everybody, back to work.